Demystifying the Capital Stack

Before jumping into investing in real estate, investors should understand these innovative opportunities before they can take advantage of them, which is why we are laying out the basics and defining the full capital stack.

What is the capital stack?

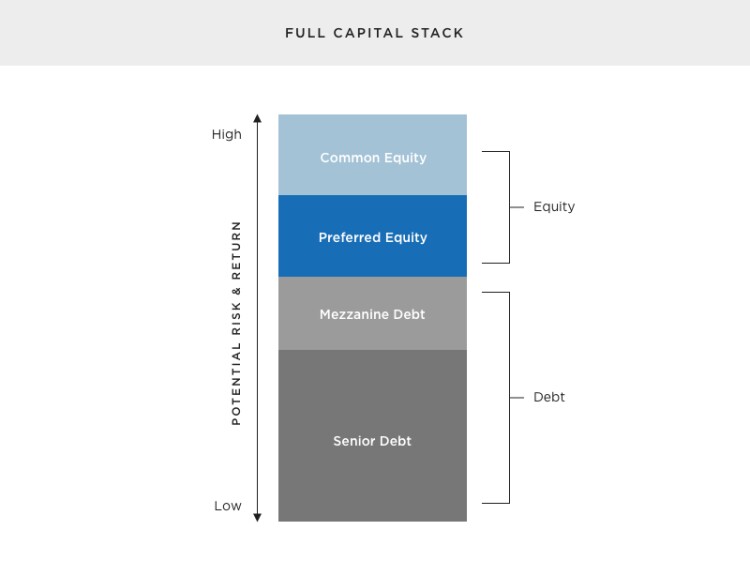

The capital stack refers to the organization of all capital contributed to finance a real estate transaction or a company. Focusing on a real estate transaction, the capital stack defines who has the rights (and in what order) to the income and profits generated by the property throughout the hold period and upon sale. More importantly, it defines who has rights to the actual asset in case of an uncured default.

When investing in commercial real estate through an online marketplace, platform or by other means, it is important to understand the capital structure of a given transaction, along with the risks and rewards associated with each piece of the capital stack. Understanding the position of an investment in the capital stack is a crucial part of the due diligence process as it will help quantify not only the potential upside, but the potential downside as well.

Essentially, the structure of the stack and an investor’s place within that structure determine how and when an investor will get paid and whether the investor has the ability to take control of the underlying property.

Senior Debt: The Foundation of the Capital Stack

It is not a bad thing to be on the bottom when it comes to the capital stack. Why? Because the bottom layer is home to the most senior debt, which is usually secured by the property, and is entitled to receive interest and principal repayment.

That means that if a property performs well and generates cash flows that are sufficient to pay periodic debt service payments (interest and sometimes principal as well), then debt holders will get their full periodic payment before any other capital contributors are paid. When the property is sold, the senior debt holders are once again paid first, receiving their outstanding principal and any accrued interest.

However, what happens if the property is underperforming and debt service payments are not met? If that happens, the lender and sponsor may negoitate some type of forebearance or other relief. But, if that is unsuccessful, in case of an uncured default, senior debt holders typically have the right to initiate a foreclosure process, take ownership of the property and liquidate it. This group will naturally be the first in line to receive any amounts due to them once the property is sold. If this occurs, there is no assurance that equity investors will receive all or any of the principal and accrued and unpaid returns. Consequently, they have first access to cash flows and collateral, putting them at the lowest risk in the stack. On the other hand, the senior debt does not typically participate in any of the upside gain following the sale of the property, its returns are limited to the amount of interest and fees accrued.

Equity: The Top Tier of the Capital Stack

At the top of the stack are common equity holders. Common equity holders have the riskiest position in the capital structure as they are paid last. Therefore, they require a higher return to compensate them for such risk. In fact, common equity holders require the highest return in the capital stack and can potentially enjoy very high rewards. They are not only entitled to recurring payments (although not guaranteed) from the property’s cash flows once all other capital holders are paid, but they also get a piece of the gain if the property is sold. Unlike debt investors, equity investors gain from appreciation.

All this reward comes at a price, of course. Common equity holders are not guaranteed to receive periodic payments, or even their principal back. The concept of foreclosure does not apply to equity. While common equity holders have rights to the property and actually own it, they pledge it as collateral and are subject to the rules of those lower in the capital stack. This can put them at risk of losing some or all of their invested principal. Unless enough excess cash is available once the property is liquidated, they will not receive their full principal back. This can happen if the property’s value depreciates over the hold period.

What is in between?

Between senior debt and common equity, there are hybrid capital instruments like mezzanine debt or preferred equity. Mezzanine debt (also known as mezz debt) is subordinate to senior debt and not secured by the property (or secured by a lien subordinated to the senior debt), but by a pledge of the ownership interest (equity, which is subordinate to mezzanine debt). Mezzanine debt holders enjoy foreclosure rights that are limited, as they are subject to agreements with the senior debt holders.

Since mezzanine holders only get paid after senior debt holders are paid, they require a higher return than the senior debt holders and will sometimes participate in additional profits generated by the property on operation or upon sale.

Preferred equity sits between debt and common equity in the capital stack. Based on this, preferred equity holders require a higher return than any debt holders, but will probably enjoy a lower return than common equity holders. Holders of preferred equity, much like mezzanine debt, will frequently participate in any upsides in addition to the periodic payment they receive.

Common equity, preferred equity, mezzanine debt and bridge loans all come together to create a well-rounded financing platform for a variety of commercial real estate projects.