Bluerock Exchange, LLC, a Delaware limited liability company, is an affiliate of Bluerock Real Estate, LLC (“Bluerock”), a private equity real estate investment firm having sponsored a portfolio currently exceeding 16 million square feet of primarily apartment and office real estate. Bluerock's senior management team has an average of over 25 years investing experience, has been involved with acquiring over 35 million square feet of real estate worth approximately $10 billion, and has helped launch leading real estate private and public company platforms. The Trust is to be managed by BR Glenwood DST Manager, LLC, a Delaware limited liability company (the “Manager”), an affiliate of Bluerock.

Bluerock Property Management, LLC (the "Property Manager") has subcontracted all day-to-day, on-site management, leasing and related functions for the Property to Greystar Real Estate Partners (the "Property Sub-Manager" or "Greystar"). Greystar has approximately 415,634 units under management and was ranked as the #1 property manager on the National Multifamily Housing Council (NHMC)'s list of top 50 mangers in the nation.*

*Per the Sponsor

The Property is a 216-unit Class A Multifamily apartment community located in one of Atlanta's desirable neighborhoods with an average household income of $89,953 (per the CBRE appraisal). The Property was delivered in April 2017 and is still in the initial lease-up phase. Occupancy was 91% as of November 2017. The unit mix consists of 30 studios, 121 one-bedroom units, and 65 two-bedroom units. Average in-place monthly rents are $1,613 per unit ranging from $1,423 to $2,417.

The Property currently offers numerous amenities including a saltwater swimming pool, fitness center, business center, bicycle repair/storage room, dog spa, bocce court, game room, and charging stations. In addition, the Property has controlled automobile and pedestrian access.

Unit amenities include wood cabinets with quartz countertops, plank flooring in the kitchen area, nine-foot ceiling, in-unit washer and dryer, LED lighting, and private patios/balconies.

| Unit Type | # of Units | Avg SF/Unit | Avg Rent/Unit | Avg Rent/SF |

|---|---|---|---|---|

| Studio | 30 | 630 | $1,287 | $2.04 |

| 1 BR / 1 BA | 121 | 732 | $1,410 | $1.92 |

| 2 BR / 2 BA | 65 | 1,087 | $1,927 | $1.77 |

| Total | 216 | 825 | $1,608 | $1.94 |

| Enso | Station R | Alexan EAV | Alexan on Krog | Inman Quarter | 675 Highland | Total / Averages | Subject | |

|---|---|---|---|---|---|---|---|---|

| # of Units | 333 | 285 | 120 | 222 | 172 | 125 | 226 | 216 |

| Year Built | 2011 | 2017 | 2016 | 2015 | 2015 | 2016 | 2015 | 2017 |

| Average SF (Per Unit) | 993 | 917 | 901 | 936 | 849 | 997 | 919 | 825 |

| Average Rental Rate (Per Unit) | $1,462 | $1,781 | $1,468 | $2,093 | $1,913 | $2,241 | $1,743 | $1,608 |

| Average Rent PSF | $1.47 | $1.94 | $1.63 | $2.24 | $2.24 | $2.25 | $1.90 | $1.94 |

Source: Newmark Knight Frank Appraisal dated August 18, 2017

| The Peninsula Buckhead | Broadstone Court | Heights at West Midtown | Alexander on Ponce | 935M | Total / Averages | Subject | |

|---|---|---|---|---|---|---|---|

| Date | Jul-17 | Jun-17 | May-17 | Jan-17 | Dec-16 | - | Dec-17 |

| # of Units | 311 | 250 | 244 | 330 | 282 | 283 | 216 |

| Year Built | 2008 | 2015 | 2016 | 2002 | 2010 | 2010 | 2017 |

| Occupancy | 95% | 95% | 90% | 95% | 96% | 94.2% | 91% |

| Purchase Price | $63,500,000 | $58,200,000 | $57,500,000 | $64,400,000 | $58,450,000 | $60,410,000 | $50,250,000 |

| $/Unit | $204,180 | $232,800 | $235,656 | $195,152 | $207,270 | $215,012 | $232,639 |

| Cap Rate | 5.21% | 4.70% | 3.78% | 5.00% | 4.95% | 4.73% | 5.4% |

| Class | A | A | A | A | A | - | A |

Source: CBRE Appraisal dated November 13, 2017

Property Appraisal available upon request. Please email investor-help@realtymogul.com.

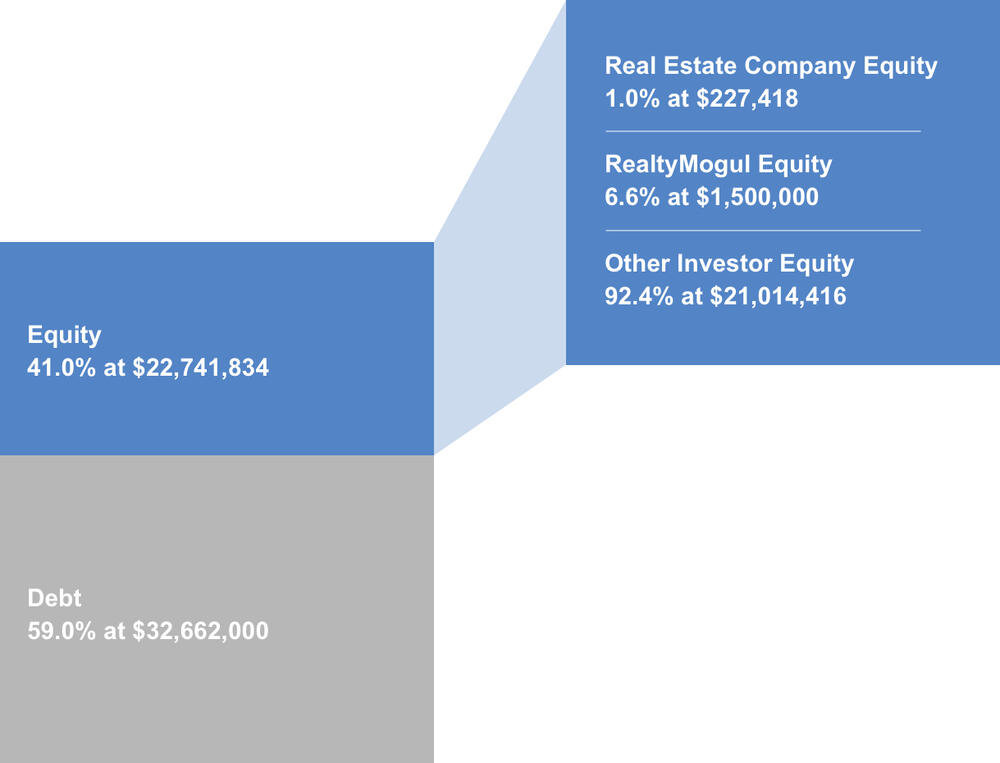

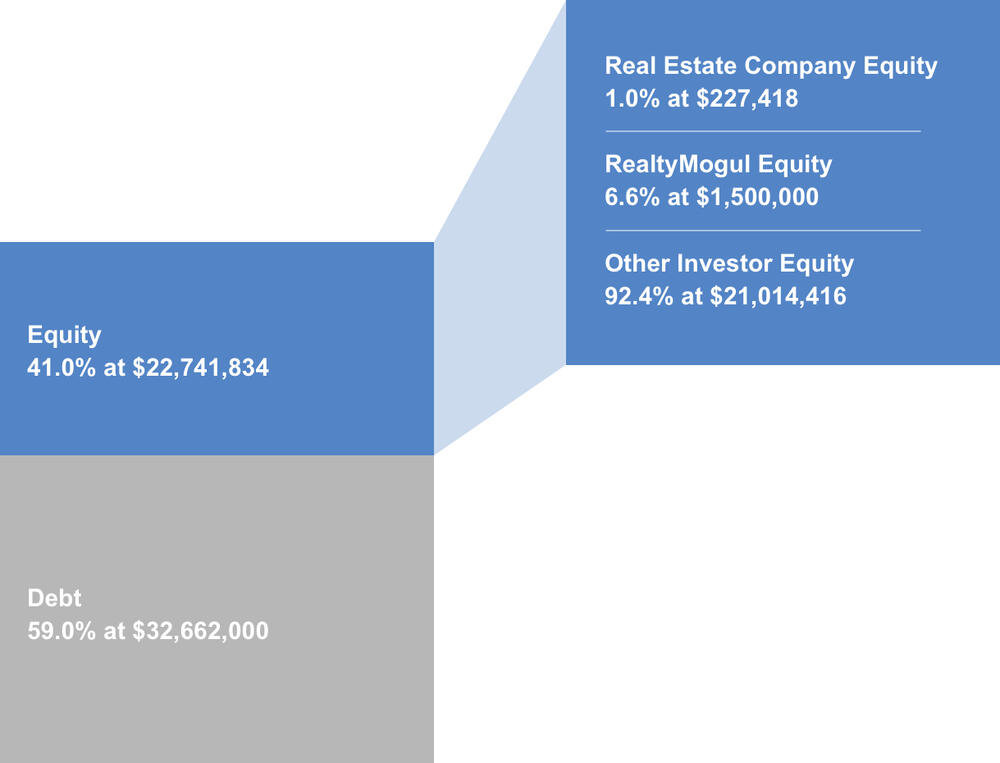

| Sources of Funds | Cost |

|---|---|

| Debt | $32,662,000 |

| Equity | $22,741,834 |

| Total Sources of Funds | $55,403,834 |

| Uses of Funds | Cost |

| Purchase Price | $50,250,000 |

| Acquisition Fee | $1,005,000 |

| Financing and Other Closing Costs | $1,285,992 |

| Selling Commissions | $1,364,510 |

| Dealer Fee | $284,273 |

| Placement Agent Fee | $318,386 |

| Organizational & Offering Expenses | $136,451 |

| Lender Controlled Reserves | $108,000 |

| Trust Controlled Reserves | $400,000 |

| Acquisition Closing Costs | $251,222 |

| Total Uses of Funds | $55,403,834 |

The Property has existing debt:

- Loan Origination Date: 12/13/2017

- Lender: KeyBank Fannie Mae DUS

- Loan Proceeds: $32,662,000

- Loan to Cost: 59.0%

- Interest Rate: 4.21% Fixed

- Amortization: 30-year amortization

- Interest Only: 5-year interest-only

- Recourse: Non-recourse to the Trust, but recourse to the Trust and principals of the Sponsor for certain (i) "bad acts", and (ii) environmental indemnification

- Term: 10 years

- Yield Maintenance: 84 months with a minimum 1% of outstanding loan floor

- Prepayment Penalty: 1% if loan repaid after the expiration of yield maintenance period but before the last calendar day of the fourth month prior to the month in which the loan matures

The Sponsor is to make distributions directly to investors who own a beneficial interest in the DST on a pro-rata basis.

Distributions are expected to start for each investor within 45 days of the completion of that investors purchase of beneficial interest in the DST. Distributions are targeted to continue on a monthly basis thereafter. These distributions are at the discretion of the Sponsor and made directly by the Sponsor, neither Realty Mogul Co. nor any of its affiliates have any control or discretion on the timing or amount of distributions.

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Acquisition Fee | $1,005,000 | Sponsor | Capitalized Equity Contribution | 2.0% of Purchase Price. |

| Selling Commission | 6.00% of offering proceeds | Broker Dealers | Capitalized Equity Contribution | Paid to North Capital(1) or other licensed broker-dealers that are Selling Group Members based on the amount of equity capital raised. Surplus fees retained by Sponsor. |

| Dealer Fee | 1.25% of offering proceeds | Broker Dealers | Capitalized Equity Contribution | 1.25% based on the amount of equity invested by investors through RealtyMogul.com, third-party Broker Dealers (including North Capital(1)) are entitled to additional fees based on equity they originate. Surplus fees retained by Sponsor. |

| Placement Agreement Fee | 1.40% of offering proceeds | Broker Dealers | Capitalized Equity Contribution | Managing Broker-Dealer will receive a fee up to 1.4% of the Total Sales, which it may at its sole discretion partially re-allow to Selling Group Members for non-accountable marketing expenses in addition to any other allowances. |

| Organization and Offering Expenses | 0.60% of offering proceeds | Sponsor | Capitalized Equity Contribution | The Sponsor and its affiliates will be entitled to reimbursement for Organization and Offering Expenses, on an accountable basis, estimated at $136,451 or 0.60% of the Offering Amount. |

| Disposition Fee | 3.50% | Sponsor | Sale Proceeds | 3.5% of Sales Price |

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Asset Management Fee | 0.20% of Purchase Price | Manager | Operating Cash Flow | |

| Property Management Fee | 2.5% of Effective Gross Income | Property Manager | Operating Cash Flow | GREP Southeast, LLC ("GREP"), an unaffiliated party, will perform the property management on the Property. GREP is an affiliate of Greystar Real Estate Partners |

| Master Lease Operating Profit | N/A | Master Lessee | Operating Cash Flow | The Master Lessee will retain net operating revenues from the Property that exceed the total rent payable to the Trust under the Master Lease. |

Notes:

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

The above presentation is based upon information supplied by the Sponsor or others. Realty Mogul, Co. along with its respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

This content does not constitute an offer to sell or a solicitation of an offer to buy any securities. RealtyMogul.com and North Capital Private Securities are in the process of screening, performing due diligence, and verifying information for the offering. The content is presented to gauge interest only and is subject to change without notice.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.