Crown Bay Group ("Crown Bay"), founded in 2013 is actively involved in the acquisition, asset management, renovation, repositioning and disposition of value-add apartment assets. Their primary investment strategy is to seek out properties that can be bought at a discount and then expeditiously resolve problem issues with the purpose of increasing net cash flow and in turn increasing the market value to the subject property.

The Real Estate Company will employ their related entity Crown Bay Management, LLC (“CBM”) as the property manager. CBM is managed by Director of Property Management, Michelle Fischer, Regional Property Manager, Jarrett Turner and Regional Maintenance Director/Project Manager, Dion Varner. Both Ms. Fischer and Mr. Turner have previous experience managing similar properties in the Columbia-area. Mr. Turner previously managed the 300-unit Arbors at Windsor Lake from September 2009 to March 2011, the 420-unit Greenbrier Apartments from September 2009 to March 2011, the 280-unit Lullwater at Saluda from June 2010 to December 2016 and the 300-unit Paddock Club from June 2010 to May 2011. Ms. Fischer and Mr. Varner were also involved with Lullwater at Saluda and Paddock Club. First Communities, a large national multifamily management company, will handle the back-office components.

Lake Shore Village, located on almost 23 acres, enjoys some of the larger floorplans in the submarket, offers a well-appointed amenity package and attractive unit features. Amenities include a lakefront swimming pool, dog park, grilling areas, fitness center, large clubhouse and a 33-acre lake. The Property’s units, which average 959 SF, feature walk-in closets, fully-equipped kitchens, large patios and balconies, outside storage and washer/dryer connections in select units.

The Property was originally developed in 1974 as a 296-unit apartment community. In April 2016, a fire destroyed an entire building at the Property next to the office. A total of 16 units were destroyed in the fire and are not planned to be reconstructed. The footprint of the burnt down building will become the new community amenity area.

The Property enjoys an amenity rich location with with easy access to popular retail destinations, including East Point Plaza and Garners Ferry Marketplace are within walking distance of Lake Shore Village and boast numerous national retailers and restaurants including Walmart, Aldi, Lowe’s and Chick-fil-A. Per Multi Housing Advisors, the Columbia MSA population of 800,495 (2013) is expected to grow by approximately 7% through 2017, adding 55,000 new residents. The City of Columbia is a “population magnet” for the surrounding area and within a 30-mile commute of a the entire MSA.

| Unit Type | # of Units | % of Total | Unit (SF) | Total SF | Rent/Unit | Rent/SF |

|---|---|---|---|---|---|---|

| Studio | 32 | 11% | 480 | 15,360 | $530 | $1.10 |

| 1 Bed, 1 Bath | 72 | 26% | 763 | 54,936 | $610 | $0.80 |

| 2 Bed, 1 Bath | 32 | 11% | 768 | 24,576 | $609 | $0.79 |

| 2 Bed, 2 Bath | 64 | 23% | 1,090 | 69,760 | $643 | $0.59 |

| 2 Bed, 1.5 Bath | 48 | 17% | 1,248 | 59,904 | $679 | $0.54 |

| 3 Bed, 3 Bath | 32 | 11% | 1,375 | 44,000 | $758 | $0.55 |

| Totals/Averages | 280 | 100% | 959 | 268,536 | $637 | $0.71 |

[[{"fid":"47726","view_mode":"default","type":"media","attributes":{"height":"885","width":"1365","style":"width: 600px; height: 389px;","class":"media-element file-default"}}]]

| Harbour Landing | Mallard Pointe | Shandon Crossing | Subject - In-Place | Comp Set Averages | |

|---|---|---|---|---|---|

| # of Units | 208 | 120 | 152 | 280 | 160 |

| Year Built | 1969 | 1973 | 1974 | 1974 | 1972 |

| Miles from Subject | 0.2 | 0.9 | 3.8 | - | - |

| Studio | |||||

| # of Units | - | - | - | 32 | - |

| Average Rent | - | - | - | $530 | - |

| Average $/SF | - | - | - | $1.10 | - |

| 1 Bedroom | |||||

| # of Units | 32 | 24 | 24 | 72 | 27 |

| Average Rent | $659 | $644 | $680 | $610 | $661 |

| Average $/SF | $0.84 | $0.76 | $0.81 | $0.80 | $0.81 |

| 2 Bedroom | |||||

| # of Units | 120 | 72 | 120 | 144 | 104 |

| Average Rent | $736 | $724 | $728 | $647 | $730 |

| Average $/SF | $0.68 | $0.69 | $0.78 | $0.60 | $0.72 |

| 3 Bedroom | |||||

| # of Units | 56 | 24 | 8 | 32 | 29 |

| Average Rent | $885 | $804 | $900 | $758 | $864 |

| Average $/SF | $0.64 | $0.64 | $0.85 | $0.55 | $0.66 |

| Source: Axiometrics | |||||

| Garners Crossing | Wellington Farms | Deer Meadow Village | Huntington Place | Subject - Post-Renovation Units | Comp Set Averages | |

|---|---|---|---|---|---|---|

| # of Units | 210 | 236 | 304 | 192 | 144 | 236 |

| Year Built | 1998 | 2000 | 2005 | 1998 | 1974 | 2000 |

| Miles from Subject | 0.1 | 0.8 | 1.4 | 2.0 | - | - |

| Studio | ||||||

| # of Units | 18 | - | - | - | 16 | 18 |

| Average Rent | $525 | - | - | - | $570 | $525 |

| Average $/SF | $1.62 | - | - | - | $1.19 | $1.62 |

| 1 Bedroom | ||||||

| # of Units | 60 | 88 | 68 | - | 37 | 72 |

| Average Rent | $734 | $768 | $798 | - | $667 | $768 |

| Average $/SF | $1.37 | $0.96 | $1.10 | - | $0.87 | $1.12 |

| 2 Bedroom | ||||||

| # of Units | 108 | 96 | 180 | 160 | 75 | 136 |

| Average Rent | $850 | $887 | $841 | $890 | $739 | $865 |

| Average $/SF | $0.86 | $0.80 | $0.88 | $0.73 | $0.64 | $0.82 |

| 3 Bedroom | ||||||

| # of Units | 24 | 52 | 86 | 32 | 16 | 41 |

| Average Rent | $850 | $972 | $1,021 | $1,060 | $858 | $988 |

| Average $/SF | $0.77 | $0.80 | $0.70 | $0.73 | $0.62 | $0.75 |

| Source: Axiometrics | ||||||

|

Austin Woods |

Harbour Landing | Forestbrook Apartments | Hunters Ridge | Subject | Comp Set Total / Averages | |

|---|---|---|---|---|---|---|

| Date | June-17 | March-17 | June-16 | May-17 | - | - |

| # of Units | 240 | 208 | 180 | 205 | 280 | 208 |

| Year Built | 1975 | 1969 | 1984 | 1972 | 1974 | 1975 |

| Purchase Price | $10,277,000 | $8,550,000 | $9,825,000 | $11,363,825 | $11,450,000 | $10,015,563 |

| $/Unit | $42,821 | $41,106 | $54,586 | $55,433 | $40,893 | $48,094 |

| Cap Rate | - | - | 5.7% | 7.0% | 6.8% | 6.4% |

| Miles from Subject | 0.2 | 0.2 | 9.0 | 11.0 | - | - |

| Source | RCA | RCA | Appraisal | Appraisal | - | - |

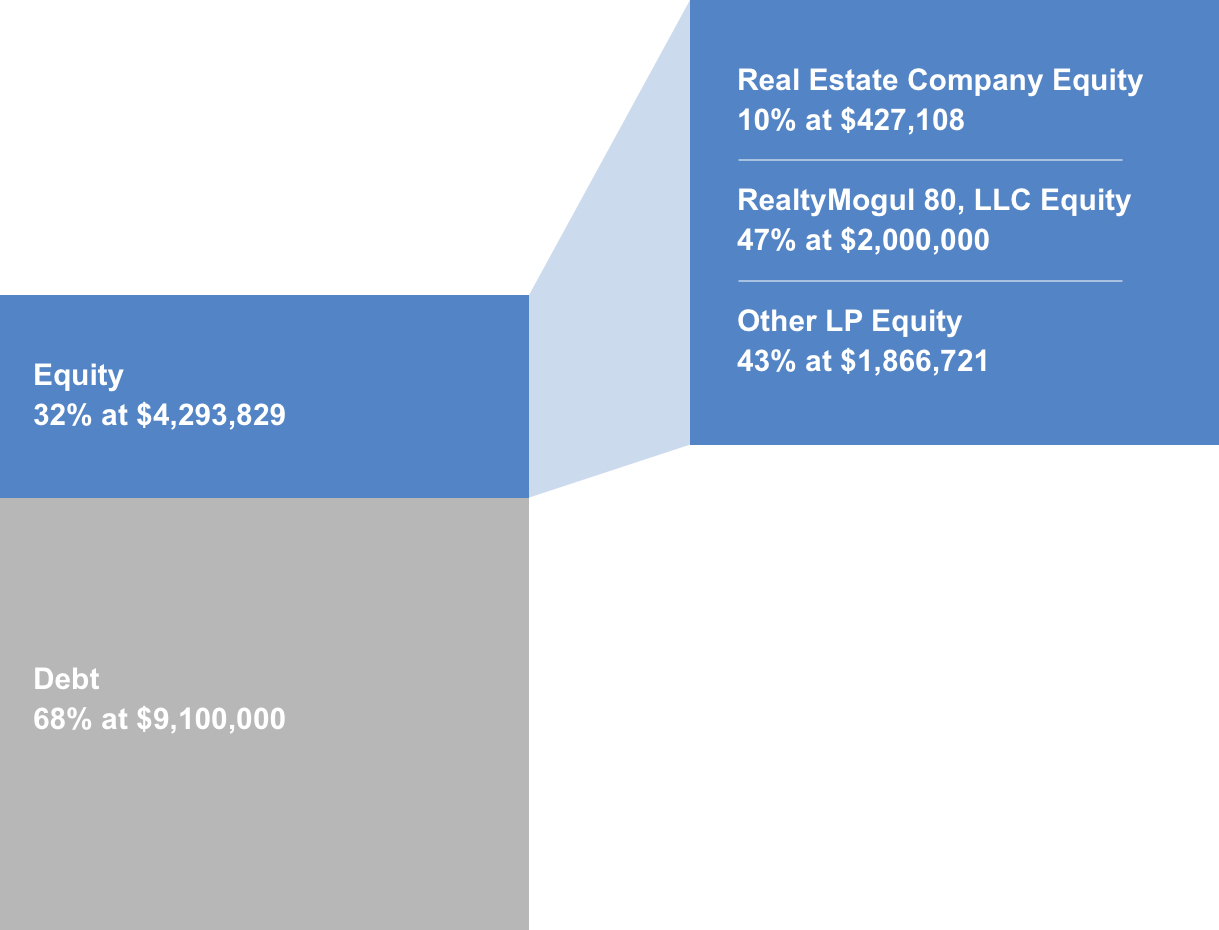

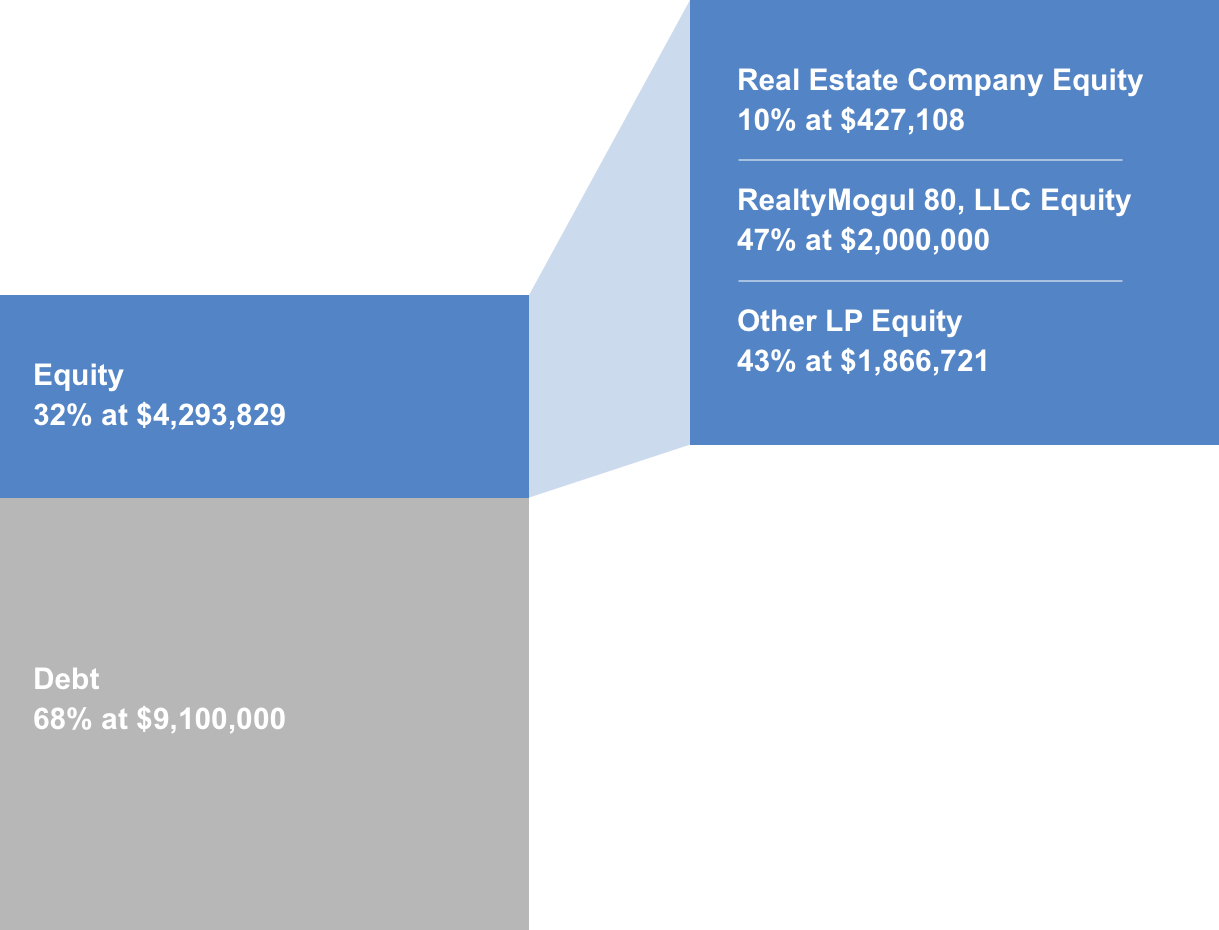

| Sources of Funds | Cost |

|---|---|

| Debt | $9,100,000 |

| Equity | $4,293,829 |

| Total Sources of Funds | $13,393,829 |

| Uses of Funds | Cost |

| Purchase Price | $11,450,000 |

| Real Estate Company Acquisition Fee | $171,750 |

| Broker Dealer Fee | $80,000 |

| Capital Expenditures | $1,086,429 |

| Closing Costs & Fees | $605,650 |

| Total Uses of Funds | $13,393,829 |

The terms of the debt financing are as follows:

- Lender: Fannie Mae - Hunt Mortgage Group

- Loan Type: Agency (7/6 ARM)

- Proceeds: $9,100,000

- Loan to Purchase: 80.0%

- Term: Seven (7) years

- Rate: One-Month LIBOR + 233 bps floating*

- Amortization: 30 years

- Interest-Only Period: N/A

- Extensions: None

- Prepayment: 12-month lockout then 1.0% until the last three months of the term

- Recourse: Non-recourse

*The interest rate has the option to be fixed at the beginning of month 13.

LVA Holdings, LLC intends to make distributions of all available cash and capital proceeds to investors (Realty Mogul 80, LLC, Other LP investors and Real Estate Company, collectively, the "Members") as follows:

- Pro rata share of cash flow to a 15% Internal Rate of Return ("IRR") hurdle;

- Excess balances will be split pro rata 70% to Members and 30% to Real Estate Company to a 20% IRR;

- Excess balances will be split pro rata 60% to Members and 40% to Real Estate Company.

Note that these distributions will occur after the payment of the Company's liabilities (loan payments, operating expenses and other fees as set forth in the LLC agreement, in addition to any member loans or returns due on member loans).

Realty Mogul 80, LLC will distribute 100% of its share of excess cash flow (after expenses and fees) to the members of Realty Mogul 80, LLC (the RealtyMogul.com investors). The manager of Realty Mogul 80, LLC will receive a portion (up to 10%) of the Real Estate Company's promote interest.

Distributions are expected to start in March 2018 and are expected to continue on a quarterly basis thereafter. These distributions are at the discretion of the Real Estate Company, who may decide to delay distributions for any reason, including maintenance or capital reserves.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Effective Gross Revenue | $2,168,368 | $2,343,300 | $2,473,306 | $2,548,579 | $2,625,464 |

| Total Operating Expenses | $1,391,528 | $1,432,505 | $1,472,651 | $1,511,603 | $1,551,642 |

| Net Operating Income | $776,840 | $910,795 | $1,000,655 | $1,036,976 | $1,073,822 |

| Distributions to Realty Mogul 80, LLC Investors | $88,129 | $143,674 | $177,847 | $189,177 | $3,641,292 |

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|---|

| Net Earnings to Investor | ($50,000) | $2,181 | $3,556 | $4,402 | $4,683 | $90,131 |

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Acquisition Fee | $171,750 | Real Estate Company | Capitalized Equity Contribution | 1.5% of the property purchase price |

| Broker-Dealer Fee | $80,000 | North Capital (1) | Capitalized Equity Contribution | 4.0% of equity raised by RealtyMogul.com ($50,000 minimum) |

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Property Management Fee | 4.0% of Effective Gross Income | Crown Bay Management | Distributable Cash | Real Estate Company Affiliate |

| Asset Management Fee | 1.0% of Effective Gross Income | Real Estate Company | Distributable Cash | |

| Construction Management Fee | 3.0%/5.0% of hard costs | Crown Bay Management | Construction Hard Costs | Real Estate Company Affiliate; 3.0% on projects up to $10,000 and 5.0% of projects over $10,000 |

| Management and Administrative Fee | 1.0% of amount invested in Realty Mogul 80, LLC | RM Manager, LLC | Distributable Cash | RM Manager, LLC is the Manager of Realty Mogul 80, LLC and a wholly-owned subsidiary of Realty Mogul, Co.2 |

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

(2) Fees may be deferred to reduce impact to investor distributions.

The above presentation is based upon information supplied by the Real Estate Company or others. Realty Mogul, Co., RM Manager, LLC, and Realty Mogul 80, LLC, along with their respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.