Arenda Capital Management, LLC (“Arenda”) is a private investment firm based in Los Angeles, CA that invests in real estate and real estate related opportunities across the United States, including both debt and equity investments, on behalf of select institutional and private investors. The firm takes an absolute return approach to its investment activities, with an emphasis on opportunities that offer superior risk-adjusted returns. Arenda’s principals have been involved in the acquisition of over 12,000 multifamily units and 580,000 square feet of retail, office and mixed-use properties in the past 12+ years. The principals of Arenda have acquired significant multifamily real estate throughout the southeast, including suburban garden style, urban apartments, and urban mid-rise apartment projects. Since 2011, Arenda Capital Management has acquired approximately $500 million of commercial real estate, while placing over $160 million of equity.

Sample Multifamily Holdings (Arenda Capital Partners II & III)

| Property | Location | Units | Total Capitalization | Status |

|---|---|---|---|---|

| Aventine at Lindbergh | Buckhead,GA | 296 | $44,720,000 | Active |

| Spinnaker Cove | Nashville, TN | 278 | $27,845,732 | Active |

| 93 East | Atlanta, GA | 192 | $12,000,000 | Active |

| Mountain Park Estates | Kennesaw, GA | 450 | $51,041,000 | Active |

| Lakeside Villages | Atlanta, GA | 310 | $22,336,000 | Active |

| Bellevue West | Nashville, TN | 560 | $56,100,000 | Active |

| Autumn Brook | Chattanooga, TN | 156 | $11,837,000 | Active |

| 10 Perimeter Park | Atlanta, GA | 230 | $27,484,000 | Active |

| Grove at Trinity Pointe | Cordova, TN | 464 | $27,025,000 | Active |

| Avondale Station | Decatur, GA | 212 | $12,291,000 | Active |

| Hawthorne Gates | Dunwoody, GA | 164 | $20,654,000 | Active |

| Courtney Station | Savannah, GA | 300 | $36,550,000 | Active |

| Madison at Schilling Farms | Collierville, TN | 324 | $33,455,000 | Active |

| Total | 3,936 | $383,338,732 |

| Address: | 425 Williams Drive Marietta, GA 30066 |

| Submarket: | Cobb/Douglas |

| Year Built: | 2001 |

| Current Occupancy: | 95% |

| Number of Units: | 358 units |

| Net Rentable Area: | 390,594 square feet |

| Buildings: | 21 total buildings 14 three and four-story garden apartment buildings 6 one-story garage/storage buildings 1 two-story clubhouse/leasing center |

| Parking: | 704 total spaces |

| Effective Rent Per Unit: | $1,027 |

| Effective Rent Per Square Foot: | $0.94 |

| UNIT TYPE | TOTAL UNITS |

AVG UNIT SF |

TOTAL SF | IN PLACE RENTS |

PSF |

|---|---|---|---|---|---|

| 1 BR X 1 BA | 126 | 771 | 97,146 | $839 | $1.09 |

| 2 BR X 2 BA | 176 | 1,219 | 214,544 | $1,074 | $0.88 |

| 3 BR X 2 BA | 56 | 1,409 | 78,904 | $1,300 | $0.92 |

| TOTAL/AVG | 358 | 1,091 | 390,594 | $1,027 | $0.94 |

Property Highlights

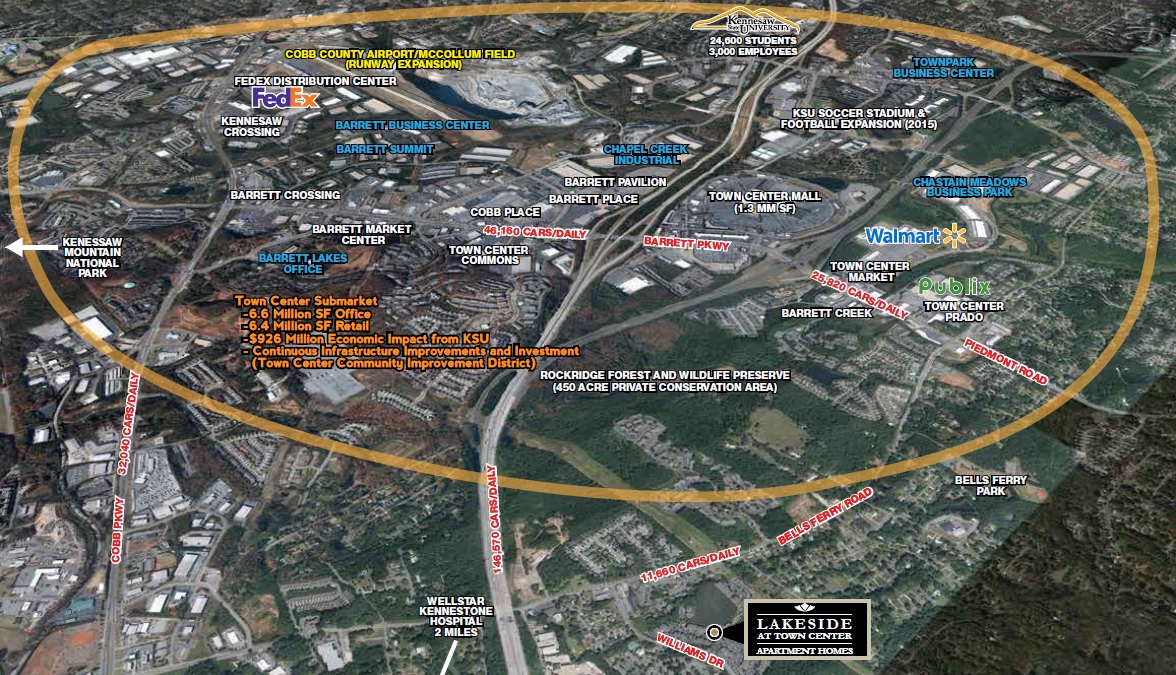

- The Property is located adjacent to I-75, a major north/south highway which provides ease of access to downtown Atlanta 20 miles to the south, as well as Kennesaw to the north.

- The Property is located near numerous demand drivers such as the 1.3 million square foot Town Center Mall (3.4 miles away), Kennesaw University (6.5 miles away), the fastest growing university in the University System of Georgia with a student body of approximately 25,000, as well as other employment and retail centers.

- The Property has significant frontage and signage along Williams Drive, and is situated 200 yards from Bells Ferry Road, which has a daily traffic count of 11,660 cars per day, and is approximately one mile west of the Canton Road Connector, which has a daily traffic count of 20,660 cars per day. Bells Ferry Road and Canton Road Connector are major local arteries that provide access to the nearby employment and retail centers.

- Amenities consist of a business center, cyber café, fitness center, swimming pool, tennis court, playground, car wash facility and a large stocked lake featuring a fountain and boardwalk.

- The Property is nicely landscaped and has been well maintained, with approximately $275,000 in capital improvements having been spent at the Property since 2012. These improvements include, but were not limited to, painting, clubhouse refurbishment, pool and deck repairs and landscaping.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.