Birge & Held is a national apartment real estate, private equity and investment firm located in Carmel, Indiana. In an effort to take advantage of strategic real estate acquisition opportunities in the distressed real estate marketplace, J. Taggart Birge and Andrew J. Held started what is now Birge & Held in 2008. Birge & Held has acquired and managed over $400,000,000 in multi-family assets across the country and currently employs over 80 professionals, per the Sponsor. Through private equity and creative debt structures, Birge & Held continues to grow its portfolio of assets. For capital investors who seek to identify and pursue apartment real estate opportunities, Birge & Held provides an experienced operating partner.

Chestnut Ridge is a 384-unit garden-style apartment complex located at 9601 Balsam Way, Jeffersontown, KY. Built in 1968, the unit mix consists of 72 one (1) bedroom, one (1) bathroom units, 201 two (2) bedroom, one (1) bathroom units, 51 two (2) bedroom, one and a half (1.5) bathroom units, 31 three (3) bedroom, one (1) bathroom units, and 29 three (3) bedroom, one and a half (1.5) bathroom units across 15 buildings. Current occupancy is 92% with in-place rents averaging $723 and ranging from $624 for one bedrooms and $851 for three bedrooms.

Amenities at the Property include a fitness center, a pool, laundry room, clubhouse, dog park, tennis court, playground, and mature landscaping. There are 528 parking spaces for a parking ratio of 1.38 spaces/unit. The Seller has renovated 23 unit interiors to date which are currently achieving rental premiums of $50-125 over unrenovated units.

| Unit Type | # of Units | Avg SF/Unit | In-Place Rent | Rent/SF | Stabilized Rent | Rent/SF |

|---|---|---|---|---|---|---|

| 1 Bed, 1 Bath | 72 | 850 | $624 | $0.73 | $659 | $0.78 |

| 2 Bed, 1 Bath | 201 | 950 | $721 | $0.76 | $783 | $0.82 |

| 2 Bed, 1.5 Bath | 51 | 950 | $739 | $0.78 | $774 | $0.81 |

| 3 Bed, 1 Bath | 31 | 1,000 | $826 | $0.83 | $861 | $0.86 |

| 3 Bed, 1.5 Bath | 29 | 1,000 | $851 | $0.85 | $886 | $0.89 |

| Total | 384 | 939 | $723 | $0.77 | $773 | $0.82 |

[[{"fid":"40224","view_mode":"default","type":"media","field_deltas":{"2":{}},"fields":{},"attributes":{"height":"602","width":"992","style":"width: 580px; height: 352px; border-width: 1px; border-style: solid;","class":"media-element file-default","data-delta":"2"}}]]

| Saddle River | Four Seasons | The Park at Hurstbourne | Mallgate at Saint Matthews | Breckenridge Square | Total / Averages | Subject - Stabilized | |

|---|---|---|---|---|---|---|---|

| Year Built | 1972 | 1975 | 1976 | 1969 | 1970 | 1972.4 | 1968 |

| # 1 Bed Units | 40 | 52 | 106 | 129 | 112 | 88 | 72 |

| 1 Bedroom Rent | $742 | $625 | $737 | $675 | $734 | $705 | $654 |

| SF | 914 | 700 | 850 | 768 | 800 | 801 | 850 |

| # 2 Bed Units | 150 | 84 | 159 | 246 | 32 | 134 | 252 |

| 2 Bedroom Rent | $852 | $745 | $777 | $832 | $814 | $812 | $780 |

| SF | 1,291 | 1,000 | 967 | 1,065 | 1,000 | 1,081 | 950 |

| # 3 Bed Units | 38 | 40 | 53 | 38 | 40 | 42 | 60 |

| 3 Bedroom Rent | $998 | $900 | $882 | $1,008 | $1,024 | $957 | $870 |

| SF | 1,525 | 1,500 | 1,260 | 1,301 | 1,550 | 1,417 | 1,000 |

| Distance | 2.4 mi | 1.9 mi | 3.2 mi | 3.8 mi | 4.0 mi |

| Subject | Saddle River | Woodbridge Apts | Willowbrook Apts | Enclave at Breckenridge | Carlisle Arms | Total / Averages | |

|---|---|---|---|---|---|---|---|

| Date | May-17 | February-17 | January-16 | December-16 | January-17 | February-16 | |

| # of Units | 384 | 228 | 360 | 120 | 384 | 67 | 232 |

| Year Built | 1968 | 1972 | 1984 | 1970 | 1970 | 1971 | 1973 |

| Purchase Price | $26,000,000 | $21,000,000 | $30,450,000 | $6,175,000 | $34,000,000 | $4,500,000 | $19,225,000 |

| $/Bed | $67,708 | $92,105 | $84,583 | $51,458 | $88,542 | $67,164 | $82,938 |

| Cap Rate | 7.54% | 5.50% | 6.22% | N/A | N/A | N/A | 5.86% |

| Distance | 2.4 mi | 6.1 mi | 5.5 mi | 3.7 mi | 4.4 mi |

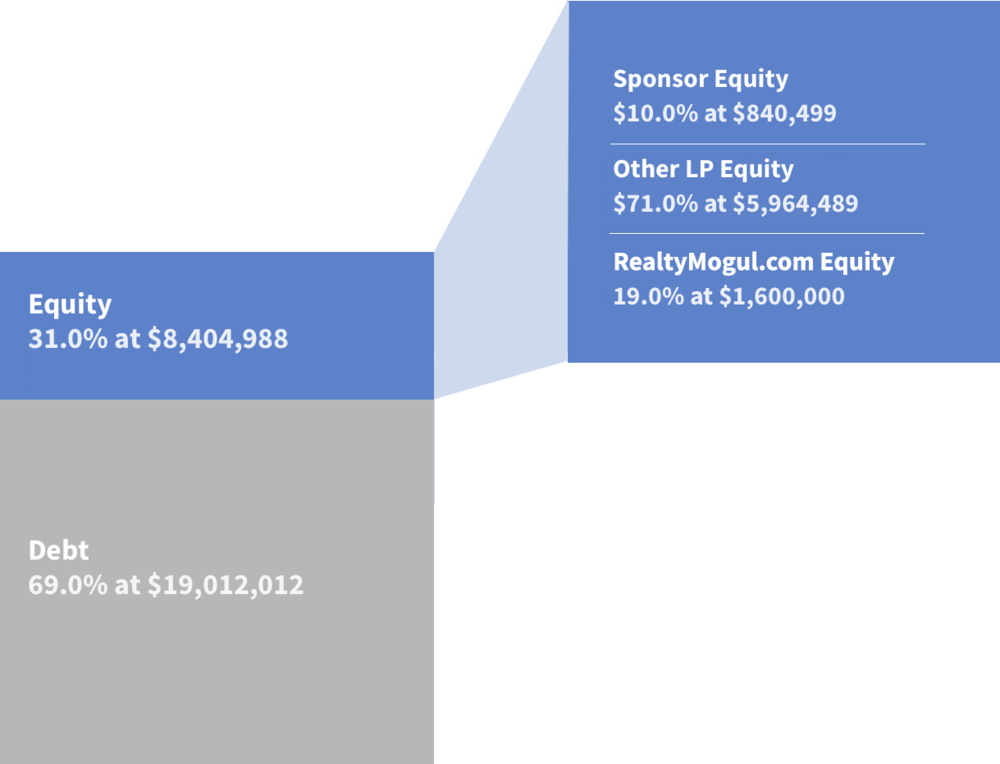

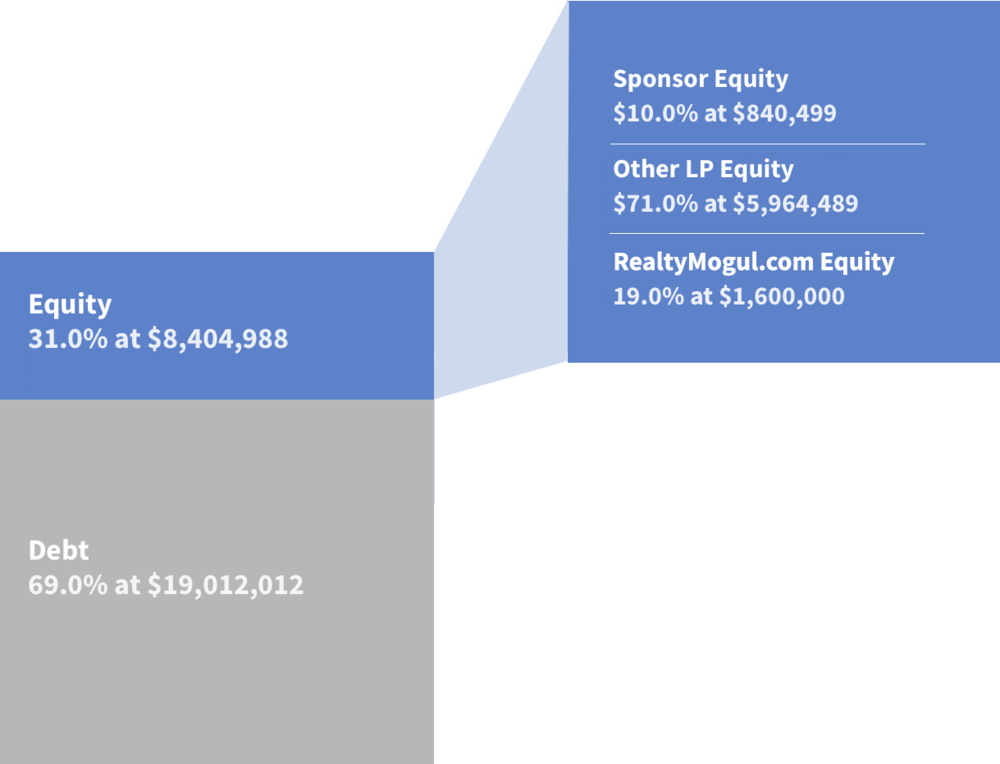

| Sources of Funds | Cost |

|---|---|

| Debt | $19,012,012 |

| Equity | $8,404,988 |

| Total Sources of Funds | $27,417,000 |

| Uses of Funds | Cost |

| Purchase Price | $26,000,000 |

| CapEx Reserve | $1,000,000 |

| Sponsor Acquisition/Guarantor Fee | $390,000 |

| Sr. Loan Assumption Costs | $490,650 |

| Supplemental Loan Financing Costs | $98,500 |

| Closing Costs | $50,000 |

| Working Capital | $285,558 |

| Broker Dealer Fee | $64,000 |

| Tax, Rent, CapEx and Deposit Credits | ($961,708) |

| Total Uses of Funds | $27,417,000 |

The projected terms of the debt financing are as follows:

Loan Assumption: Due to the yield maintenance provisions, the Sponsor anticipates assuming the loan currently in place at the Property and plans to obtain additional supplemental financing from the existing lender which is to be coterminous with the existing debt.

- Lender: Fannie Mae (Arbor)

- Estimated Balance at Closing: $15,712,012

- Rate: Fixed (5.36%)

- Amortization: 30 years

- Maturity Date: February 2024

- Prepayment Penalty: Yield maintenance until July 2023

Supplemental Debt:

- Lender: Fannie Mae (Arbor)

- Estimated Proceeds: $3,300,000

- Rate: 7 Year Treasury + 3.43% (5.61% as of 4/6/2017). Rate has not been locked yet, RM has assumed a rate of 5.75% for underwriting purposes.

- Amortization: 30 years

- Maturity Date: February 2024

- Prepayment Penalty: Yield maintenance until August 2023, 1% thereafter

There can be no assurance that a lender will provide debt on the rates and terms noted above, or at all. All rates and terms of the debt financing are subject to lender approval, including but not limited to possible increases in capital reserve requirements for funds to be held in a lender controlled capital reserve account.

BH Chestnut Ridge, LLC intends to make distributions to investors (Realty Mogul 78, LLC, Sponsor and Other LP Investors, collectively, the "Members") as follows:

Operating Cash Flow

- First, to investors for any accumulated unpaid preferred return

- Second, a cumulative non-compounded 8% annual preferred return

- Then, any excess balance will be split 70% to members pari passu (which will reduce the Member's capital accounts) and 30% to Sponsor.

Capital Events (sale, refinance)

- First, to investors for any accumulated unpaid preferred return

- Second, a cumulative non-compounded 8% annual preferred return

- Third, return of capital

- Then, any excess balance will be split 70% to members pari passu and 30% to Sponsor.

Note that these distributions will occur after the payment of the Company's liabilities (loan payments, operating expenses and other fees as set forth in the LLC agreement, in addition to any member loans or returns due on member loans).

Realty Mogul 78, LLC will distribute 100% of its share of excess cash flow (after expenses and fees) to the members of Realty Mogul 78, LLC (the RealtyMogul.com investors).

Distributions are expected to start in September 2017 and are expected to continue on a semi-annual basis thereafter. These distributions are at the discretion of the Sponsor, who may decide to delay distributions for any reason, including maintenance or capital reserves.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Effective Gross Revenue | $2,637,694 | $3,686,821 | $3,830,276 | $3,959,566 | $4,083,087 | $4,205,782 | $4,331,955 |

| Total Operating Expenses | $1,228,109 | $1,673,610 | $1,719,784 | $1,766,697 | $1,814,680 | $1,863,943 | $1,914,677 |

| Net Operating Income | $1,409,586 | $2,013,211 | $2,110,492 | $2,192,869 | $2,268,407 | $2,341,839 | $2,417,278 |

| Annual Debt Service | $1,003,490 | $1,337,987 | $1,337,987 | $1,337,987 | $1,337,987 | $1,337,987 | $1,337,987 |

|

Distributions to Realty |

$62,049 | $108,438 | $124,230 | $131,944 | $141,196 | $149,987 | $2,990,864 |

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

| One-Time Fees | ||||

|---|---|---|---|---|

| Acquisition/Guarantor Fee | $390,000 | Sponsor | Capitalized Equity Contribution | 1.5% of the Property purchase price |

| Broker-Dealer Fee | $64,000 | North Capital (1) | Capitalized Equity Contribution | 4.0% of the amount of equity raised by RealtyMogul.com |

| Recurring Fees | ||||

| Property Management Fee | 3.0% of Effective Gross Income | Sponsor | Operating Cash Flow | |

| Management and Administrative Fee | 1.0% of amount invested in Realty Mogul 78, LLC | RM Manager, LLC | Distributable Cash | RM Manager, LLC is the Manager of Realty Mogul 78, LLC and a wholly-owned subsidiary of Realty Mogul, Co. (2) |

Notes:

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

(2) Fees may be deferred to reduce impact to investor distributions.

The above presentation is based upon information supplied by the Sponsor or others. Realty Mogul, Co., RM Manager, LLC, and Realty Mogul 78, LLC, along with their respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.