Birge & Held is a national apartment real estate, private equity and investment firm located in Carmel, Indiana. In an effort to take advantage of strategic real estate acquisition opportunities in the distressed real estate marketplace, J. Taggart Birge and Andrew J. Held started what is now Birge & Held in 2008. Birge & Held has acquired and managed over $400,000,000 in multi-family assets across the country and currently employs over 80 professionals, per the Sponsor. Through private equity and creative debt structures, Birge & Held continues to grow its portfolio of assets. For capital investors who seek to identify and pursue apartment real estate opportunities, Birge & Held provides an experienced operating partner.

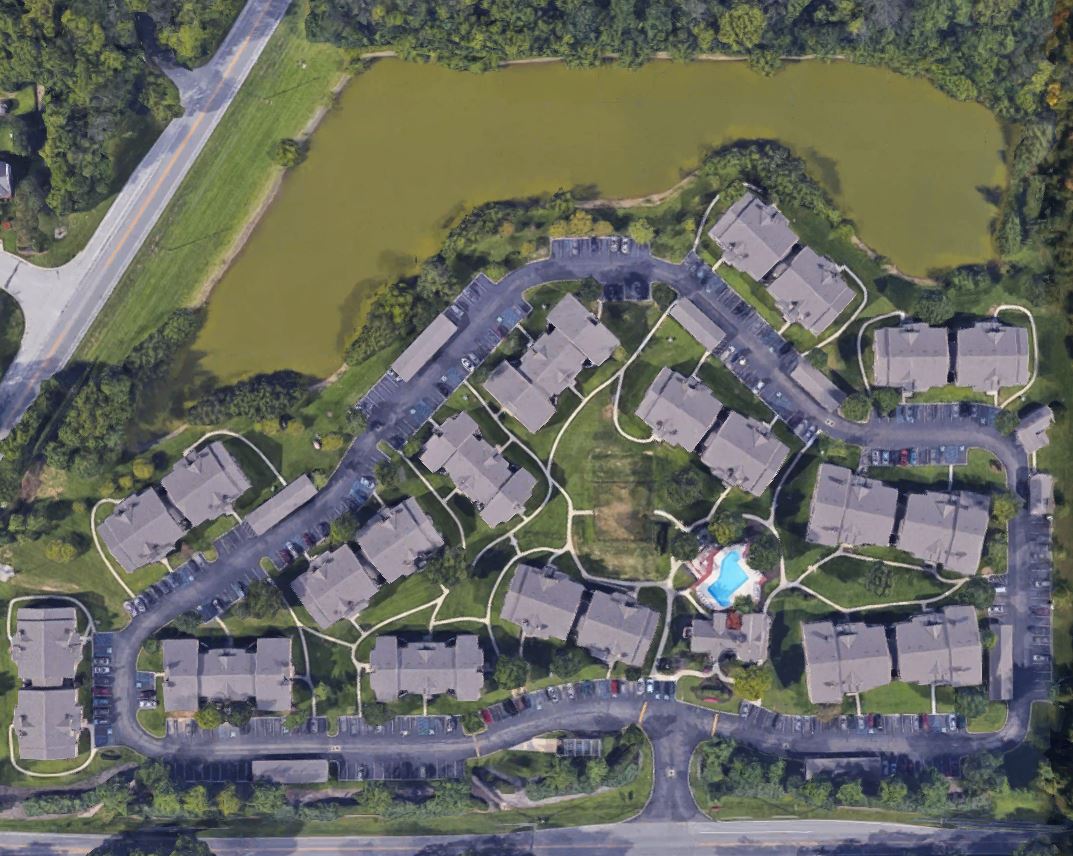

Trails at Lakeside is a 208‐unit apartment community located on Indianapolis' affluent north side. The 1989‐built Property consists of one bedroom/one bathroom, two bedroom/one bathroom, two bedroom/two bathroom and three bedroom/ two bathroom garden‐style units. Units range in size from 594 square feet for a one bedroom to 1,246 square feet for a three bedroom. The exterior finish is oriented strand board (a wood product), and the roofs are pitched with asphalt shingles.

Community amenities include a fitness center, outdoor pool and sundeck, carports, dog park, package acceptance, and 24‐hour emergency maintenance. The property features 364 parking spaces (1.75 spaces per unit), including 52 carports, and is currently 93% occupied.

| Unit Type | # of Units | % of Total | Unit SF | Avg. In-Place Rent | Avg. In-Place Rent/ SF |

|---|---|---|---|---|---|

| 1 Bed / 1 Bath (A1) | 48 | 23.1% | 594 | $626 | $1.05 |

| 1 Bed / 1 Bath (A2) | 56 | 26.9% | 752 | $743 | $0.99 |

| 2 Bed / 1 Bath | 16 | 7.7% | 910 | $793 | $0.87 |

| 2 Bed / 2 Bath | 72 | 34.6% | 1,056 | $907 | $0.86 |

| 3 Bed / 2 Bath | 16 | 7.7% | 1,246 | $1,034 | $0.83 |

| Total/ Average | 208 | 100% | 871 | $799 | $0.94 |

| 1 Bed / 1 Bath | 2 Bed / 1 Bath | 2 Bed / 2 Bath | 3 Bed / 2 Bath | |||||||||

| Property | Miles from Subject | Built | Renovated | Occ. | Avg. Size | Avg. Rent | Avg. Size | Avg. Rent | Avg. Size | Avg. Rent | Avg. Size | Avg. Rent |

| Brockton | 0.5 | 1964 | Partial - 2013 | 95% | 734 | $794 | 844 | $811 | 1,119 | $994 | 1,340 | $1,129 |

| Ashford at Keystone | 2.7 | 1967 | Partial - 2013 | 94% | 700 | $720 | 900 | $795 | - | - | 1,056 | $1,145 |

| Monon Place - Phase I | 3 | 1966 | 2013 | 96% | - | - | 860 | $913 | 1,088 | $1,160 | 1,320 | $1,732 |

| Shadeland Station | 4.6 | 1984 | 2011 | 99% | 700 | $728 | - | - | 1,000 | $868 | - | - |

| Chateau De Ville | 0.1 | 1965 | - | 95% | 700 | $666 | 991 | $768 | 1,350 | $868 | 1,550 | $990 |

| Chateau in the Woods | 0.3 | 1973 | - | 97% | 712 | $679 | 1,182 | $799 | 1,144 | $774 | 1,590 | $1,009 |

| Bayview Club | 4.4 | 2003 | - | 94% | 722 | $795 | - | - | 1,052 | $855 | 1,242 | $1,155 |

| Average | 2.2 | 1975 | 96% | 711 | $730 | 955 | $817 | 1,126 | $920 | 1,350 | $1,193 | |

| Subject - In-Place | 1989 | Partial - 2015 | 93% | 679 | $676 | 910 | $793 | 1,056 | $907 | 1,246 | $1,034 | |

| Discount to Comp Set | $54 | $24 | $13 | $159 | ||||||||

*Sources: Axiometrics, Costar, Tikijian Associates

| Property Name | Miles from Subject | Date Sold | Class | Year Built | Number of Units | Sales Price | Price/Unit | Cap Rate |

| Bayview Club | 4.4 | May-15 | B+ | 2002 | 236 | $25,300,000 | $107,203 | n/a |

| Woods of Castleton | 5.6 | May-16 | B | 1982 | 260 | $16,500,000 | $63,462 | 5.9% |

| Conner Farms | 9.7 | Dec-15 | A- | 1995 | 300 | $33,200,000 | $110,667 | 5.4% |

| Park at Eagle Creek | 10.5 | Mar-16 | A- | 1997 | 240 | $24,300,000 | $101,250 | 5.9% |

| Oaks of Eagle Creek | 10.7 | Sep-15 | B | 1987 | 632 | $44,500,000 | $70,411 | 6.2% |

| Eagle Lake Landing | 12.3 | Mar-15 | B+ | 1976 | 277 | $13,200,000 | $47,653 | 7.0% |

| Eagle Chase | 12.5 | Nov-15 | B+ | 1995 | 156 | $15,736,041 | $100,872 | 6.0% |

| Riverchase | 13.4 | May-15 | B+ | 2000 | 216 | $16,150,000 | $74,769 | 6.0% |

| Eagle Creek | 14.3 | Mar-14 | B- | 1972 | 188 | $12,350,000 | $65,691 | 6.7% |

| Village on Spring Mill | 15.5 | Oct-15 | A- | 1997 | 400 | $50,000,000 | $125,000 | 5.3% |

| Mission Hills | 20.6 | Oct-15 | B+ | 1982 | 267 | $17,500,000 | $65,543 | 6.4% |

| Total/ Average | 11.8 | 1990 | 288 | $24,430,549 | $84,775 | 6.1% | ||

| Subject | B | 1989 | 208 | $16,000,000 | $76,923 | 6.1% |

Sources: Real Capital Analytics, Costar, Tikijian Associates

| Sources of Funds | Cost |

|---|---|

| Debt | $13,695,000 |

| Equity | $4,109,773 |

| Total Sources of Funds | $17,804,773 |

| Uses of Funds | Cost |

| Purchase Price | $16,000,000 |

| Bridge Loan Escrows & Other Costs | $100,000 |

| Sponsor Acquisition/ Guarantor Fee | $240,000 |

| HUD Financing Costs | $18,110 |

| Working Capital/ PCNA Contingency | $102,500 |

| Bridge Loan Financing Costs | $94,163 |

| Due Diligence, Legal & Closing Costs | $50,000 |

| Broker-Dealer Placement Fee | $60,000 |

| Capital Reserves (Pre-HUD) | $1,140,000 |

| Total Uses of Funds | $17,804,773 |

The projected terms of the debt financing are as follows:

Bridge Loan

- Lender: Merchants Bank of Indiana

- Total Proceeds: $13,695,000

- Term: 12 Months

- Rate: 30 Day LIBOR + 275 bps

- Amortization: Interest Only

- Loan to Cost: 76.9%

- Loan to Purchase Price: 85.6%

Permanent Loan

- Lender: HUD

- Principal Balance: $15,420,000

- Term: 35 Years

- Rate: 3.50%

- Amortization: 35 Years

- Loan to Value: 85% of Purchase Price + Repair Reserves

There can be no assurance that a lender will provide debt on the rates and terms noted above, or at all. All rates and terms of the debt financing are subject to lender approval, including but not limited to possible increases in capital reserve requirements for funds to be held in a lender controlled capital reserve account.

Order of Distributions to Realty Mogul 34, LLC (Operating Income)

- First, to investors for any accumulated unpaid preferred return

- Second, a cumulative non-compounded 8% annual preferred return

- Then, any excess balance will be split 70% to members pari passu and 30% to Sponsor

Order of Distributions to Realty Mogul 34, LLC (Sales or Refinance Proceeds)

- First, to investors for any accumulated unpaid preferred return

- Second, return of Capital Contribution

- Then, any excess balance will be split 70% to members pari passu and 30% to Sponsor

Realty Mogul 34, LLC is expected to distribute 100% of its share of excess cash flow (after expenses) to the members of Realty Mogul 34, LLC (the RealtyMogul.com investors). The manager of Realty Mogul 34, LLC is to receive a portion (up to 10%) of the Sponsor's promote interest. Depreciation and tax losses will be allocated based on the promote structure, i.e. 70/30 (70% to members, 30% to Sponsor). Solely in connection with the contribution of the Property to a "real estate investment trust" (as defined under IRS Code Section 856), the Sponsor may require that after at least one year of ownership, investors agree to sell any portion of their equity units at a price equal to the greater of fair market value or the amount required to achieve a 20% IRR to the investor.

Distributions are projected to start in March 2017 and are projected to continue on a quarterly basis thereafter, until the Sponsor obtains HUD Financing, after which distributions are projected to be made semi-annually. These distributions are at the discretion of the Sponsor, who may decide to delay distributions for any reason, including maintenance or capital reserves.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | |

|---|---|---|---|---|---|---|---|

| Effective Gross Revenue | $2,038,383 | $2,170,432 | $2,313,664 | $2,405,191 | $2,486,923 | $2,571,557 | $2,657,128 |

| Total Operating Expenses | $927,630 | $956,891 | $1,013,135 | $1,068,827 | $1,125,688 | $1,184,273 | $1,218,734 |

| Net Operating Income | $1,110,753 | $1,213,541 | $1,300,528 | $1,336,364 | $1,361,235 | $1,387,284 | $1,438,394 |

| Distributions to Realty Mogul 34, LLC Investors | $100,900 | $119,144 | $159,976 | $169,508 | $176,251 | $183,310 | $2,633,993 |

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

| One-Time Fees: | ||||

|---|---|---|---|---|

| Acquisition/ Guarantor Fee | $240,000 | Sponsor | Capitalized Equity Contribution | 1.50% of the Property purchase price |

| Broker-Dealer Fee | 4.0% | North Capital (1) | Capitalized Equity Contribution | 4.0% based on the amount of equity invested by Realty Mogul 34, LLC |

| Recurring Fees: | ||||

| Property Management Fee | 4.0% of monthly gross revenue, plus $3.00 per unit per month | Sponsor | Operating Cash Flow | 4.0% of monthly gross revenue, plus an additional $3.00 per unit per month for the use of the Sponsor's centralized office resources |

| Management and Administrative Fee | 1.0% of amount invested in Realty Mogul 34, LLC | RM Manager, LLC | Distributable Cash | RM Manager, LLC is the Manager of Realty Mogul 34, LLC and a wholly-owned subsidiary of Realty Mogul, Co. (2) |

Notes:

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

(2) Fees may be deferred to reduce impact to investor distributions

The above presentation is based upon information supplied by the Sponsor or others. Realty Mogul, Co., RM Manager, LLC, and Realty Mogul 34, LLC, along with their respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.