ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 investors. Their goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. They target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

| Tenant | Location | Credit Rating (S&P) | Size | Yr Built | Annual Rent | Lease Type | Lease Expiration |

| Advance Auto Parts | New Bern, NC | BBB- | 7,050 | 2005 | $82,600 | NN | 12/31/2024 |

| Advance Auto Parts | Superior, WI | BBB- | 6,878 | 2008 | $119,837 | NN | 9/30/2026 |

| Advance Auto Parts | Dalton, GA | BBB- | 6,400 | 2010 | $111,756 | NN | 12/31/2029 |

| CVS/Pharmacy | Las Vegas, NV | BBB+ | 5,000 |

2010 | $384,390 | NN | 12/31/2026 |

| Dollar General | Douglasville, GA |

BBB- | 5,000 |

2010 | $98,700 | NNN | 8/31/2030 |

| Dollar General | Gretna, LA | BBB- | 5,000 |

2010 | $122,873 | NNN | 4/30/2029 |

| Dollar General | Sumter, SC | BBB- | 5,000 | 2010 |

$79,009 | NN | 12/31/2025 |

| Dollar General | Shreveport, LA | BBB- | 5,000 |

2010 |

$90,729 | NNN | 6/30/2026 |

| Dollar General | Mobile, AL | BBB- | 5,000 |

2010 |

$82,740 | NN | 7/31/2025 |

| Family Dollar | Shreveport, LA | Ba2* | 5,000 |

2010 | $114,917 | NNN | 3/31/2031 |

| Family Dollar | Cocoa, FL | Ba2* | 5,000 | 23 2010 |

$121,892 | NNN | 3/31/2031 |

| Hobby Lobby | Lawrenceville, GA | N/A | 5,000 | 2010 |

$467,500 | NN | 7/31/2029 |

| NAPA Auto Parts | Morton, IL | N/A | 5,000 | 2010 | $99,000 | NNN | 11/08/2035 |

| NAPA Auto Parts | Bloomington, IL |

N/A | 5,000 | 2010 |

$102,000 |

NNN | 11/08/2035 |

| NAPA Auto Parts | Decatur, IL | N/A | 6,746 | $69,000 | NNN | 11/23/2035 | |

| Sherwin Williams | Winston-Salem, NC | A- | 10,186 |

2010 |

$125,000 | NN | 10/31/2025 |

| Walgreens | Lawrenceville, GA |

BBB | 15,066 | 2010 |

$395,000 | NNN | 3/31/2026 |

*Moody's credit rating

Headquartered in Roanoke, Va., Advance Auto Parts, Inc., the largest automotive aftermarket parts provider in North America, serves both the professional installer and do-it-yourself customers. Advance operates over 5,200 stores, over 100 Worldpac branches and serves approximately 1,300 independently owned Carquest branded stores in the United States, Puerto Rico, the U.S. Virgin Islands and Canada. Advance employs approximately 74,000 Team Members. Advance Auto Parts trades on the New York Stock Exchange under the AAP symbol.

Headquartered in Roanoke, Va., Advance Auto Parts, Inc., the largest automotive aftermarket parts provider in North America, serves both the professional installer and do-it-yourself customers. Advance operates over 5,200 stores, over 100 Worldpac branches and serves approximately 1,300 independently owned Carquest branded stores in the United States, Puerto Rico, the U.S. Virgin Islands and Canada. Advance employs approximately 74,000 Team Members. Advance Auto Parts trades on the New York Stock Exchange under the AAP symbol.

CVS Pharmacy is an American pharmacy retailer and currently stands as the second largest pharmacy chain, after Walgreens, in the United States, with more than 7,600 stores,and is the second largest US pharmacy based on total prescription revenue. As the retail pharmacy division of CVS Health, it ranks as the 12th largest company in the world according to Fortune 500 in 2014. CVS Pharmacy's leading competitor Walgreens ranked 37th. CVS sells prescription drugs and a wide assortment of general merchandise, including over-the-counter drugs, beauty products and cosmetics, film and photo finishing services, seasonal merchandise, greeting cards, and convenience foods through their CVS Pharmacy and Longs Drugs retail stores and online through CVS.com. It also provides healthcare services through its more than 1,000 MinuteClinic medical clinics as well as their Diabetes Care Centers. Most of these clinics are located within CVS stores.

CVS Pharmacy is an American pharmacy retailer and currently stands as the second largest pharmacy chain, after Walgreens, in the United States, with more than 7,600 stores,and is the second largest US pharmacy based on total prescription revenue. As the retail pharmacy division of CVS Health, it ranks as the 12th largest company in the world according to Fortune 500 in 2014. CVS Pharmacy's leading competitor Walgreens ranked 37th. CVS sells prescription drugs and a wide assortment of general merchandise, including over-the-counter drugs, beauty products and cosmetics, film and photo finishing services, seasonal merchandise, greeting cards, and convenience foods through their CVS Pharmacy and Longs Drugs retail stores and online through CVS.com. It also provides healthcare services through its more than 1,000 MinuteClinic medical clinics as well as their Diabetes Care Centers. Most of these clinics are located within CVS stores.

Dollar General Corporation, incorporated on May 29, 1998, is the discount retailer in the United States. The Company offers a selection of merchandise, including consumables, seasonal, home products and apparel. Its merchandise includes national brands from manufacturers, as well as private brand selections with prices at discounts to national brands. It offers its merchandise at everyday low prices through its convenient small-box locations, with selling space averaging approximately 7,400 square feet. The Company sells national brands from manufacturers, such as Procter & Gamble, PepsiCo, Coca-Cola, Nestle, General Mills, Unilever, Kimberly Clark, Kellogg's and Nabisco, which are typically found at higher retail prices elsewhere. Additionally, its private brand consumables offer even greater value with options to purchase value items and national brand equivalent products at substantial discounts to the national brand. The Company operates approximately 11,879 stores located in 43 states located in the southern, southwestern, midwestern and eastern United States.

Dollar General Corporation, incorporated on May 29, 1998, is the discount retailer in the United States. The Company offers a selection of merchandise, including consumables, seasonal, home products and apparel. Its merchandise includes national brands from manufacturers, as well as private brand selections with prices at discounts to national brands. It offers its merchandise at everyday low prices through its convenient small-box locations, with selling space averaging approximately 7,400 square feet. The Company sells national brands from manufacturers, such as Procter & Gamble, PepsiCo, Coca-Cola, Nestle, General Mills, Unilever, Kimberly Clark, Kellogg's and Nabisco, which are typically found at higher retail prices elsewhere. Additionally, its private brand consumables offer even greater value with options to purchase value items and national brand equivalent products at substantial discounts to the national brand. The Company operates approximately 11,879 stores located in 43 states located in the southern, southwestern, midwestern and eastern United States.

For more than 50 years, Family Dollar has been providing value and convenience to customers in easy-to-shop neighborhood locations. Family Dollar’s mix of name brands and quality, private brand merchandise, appeals to shoppers in more than 8,100 stores in rural and urban settings across 46 states.

For more than 50 years, Family Dollar has been providing value and convenience to customers in easy-to-shop neighborhood locations. Family Dollar’s mix of name brands and quality, private brand merchandise, appeals to shoppers in more than 8,100 stores in rural and urban settings across 46 states.

Hobby Lobby Stores, Inc., headquartered in Oklahoma City, OK, operates over 600 stores across the nation that average 55,000 square feet. Hobby Lobby is an industry leading retailer offering more than 70,000 arts, crafts, hobbies, home decor, Holiday, and seasonal products. Hobby Lobby is included in Forbes’ annual list of America’s largest private companies. While Hobby Lobby continues to grow steadily, the company carries no long-term debt.

Hobby Lobby Stores, Inc., headquartered in Oklahoma City, OK, operates over 600 stores across the nation that average 55,000 square feet. Hobby Lobby is an industry leading retailer offering more than 70,000 arts, crafts, hobbies, home decor, Holiday, and seasonal products. Hobby Lobby is included in Forbes’ annual list of America’s largest private companies. While Hobby Lobby continues to grow steadily, the company carries no long-term debt.

In the U.S., NAPA includes over 60 distribution centers, 15,000 NAPA AutoCare Centers and more than 6,000 independently-owned and company-owned stores. NAPA carries an extensive inventory of more than 400,000 parts for automotive and industrial applications. A division of Genuine Parts Company (NYSE: GPC) and a global automotive aftermarket leader, NAPA operates NAPA Canada, Auto Todo in Mexico and Repco in Australia and New Zealand.

In the U.S., NAPA includes over 60 distribution centers, 15,000 NAPA AutoCare Centers and more than 6,000 independently-owned and company-owned stores. NAPA carries an extensive inventory of more than 400,000 parts for automotive and industrial applications. A division of Genuine Parts Company (NYSE: GPC) and a global automotive aftermarket leader, NAPA operates NAPA Canada, Auto Todo in Mexico and Repco in Australia and New Zealand.

The Sherwin-Williams Company (Sherwin-Williams), incorporated on July 16, 1884, is engaged in the development, manufacture, distribution and sale of paint, coatings and related products to professional, industrial, commercial and retail customers in North and South America with additional operations in the Caribbean region, Europe and Asia. The Company has four operating segments: Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. The Paint Stores Group markets and sells architectural paint and coatings, protective and marine products, original equipment manufacturer (OEM) product finishes and related items. The Consumer Group develops, manufactures and distributes a range of paint, coatings and related products to third party customers. The Global Finishes Group develops, licenses, manufactures, distributes and sells a range of protective and marine products, automotive finishes and refinished products, OEM product finishes and related products. The Latin America Coatings Group develops, licenses, manufactures, distributes and sells a range of architectural paint and coatings, protective and marine products, OEM product finishes and related products in North and South America.

The Sherwin-Williams Company (Sherwin-Williams), incorporated on July 16, 1884, is engaged in the development, manufacture, distribution and sale of paint, coatings and related products to professional, industrial, commercial and retail customers in North and South America with additional operations in the Caribbean region, Europe and Asia. The Company has four operating segments: Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. The Paint Stores Group markets and sells architectural paint and coatings, protective and marine products, original equipment manufacturer (OEM) product finishes and related items. The Consumer Group develops, manufactures and distributes a range of paint, coatings and related products to third party customers. The Global Finishes Group develops, licenses, manufactures, distributes and sells a range of protective and marine products, automotive finishes and refinished products, OEM product finishes and related products. The Latin America Coatings Group develops, licenses, manufactures, distributes and sells a range of architectural paint and coatings, protective and marine products, OEM product finishes and related products in North and South America.

Walgreens is the largest drug retailing chain in the United States. As of February 29, 2016, the company operated 8,177 stores in all 50 states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands. It was founded in Chicago, Illinois, in 1901. The Walgreens headquarters office is in the Chicago suburb of Deerfield, Illinois. In 2014, the company agreed to purchase the remaining 55% of Switzerland-based Alliance Boots that it did not already own to form a global business. Under the terms of the purchase, the two companies merged to form a new holding company, Walgreens Boots Alliance Inc., on December 31, 2014. Walgreens became a subsidiary of the new company, which retains its Deerfield headquarters and trades on the Nasdaq under the symbol WBA (wiki)

Walgreens is the largest drug retailing chain in the United States. As of February 29, 2016, the company operated 8,177 stores in all 50 states, the District of Columbia, Puerto Rico and the U.S. Virgin Islands. It was founded in Chicago, Illinois, in 1901. The Walgreens headquarters office is in the Chicago suburb of Deerfield, Illinois. In 2014, the company agreed to purchase the remaining 55% of Switzerland-based Alliance Boots that it did not already own to form a global business. Under the terms of the purchase, the two companies merged to form a new holding company, Walgreens Boots Alliance Inc., on December 31, 2014. Walgreens became a subsidiary of the new company, which retains its Deerfield headquarters and trades on the Nasdaq under the symbol WBA (wiki)

Appraisals for all properties available upon request. Please email investor-help@realtymogul.com.

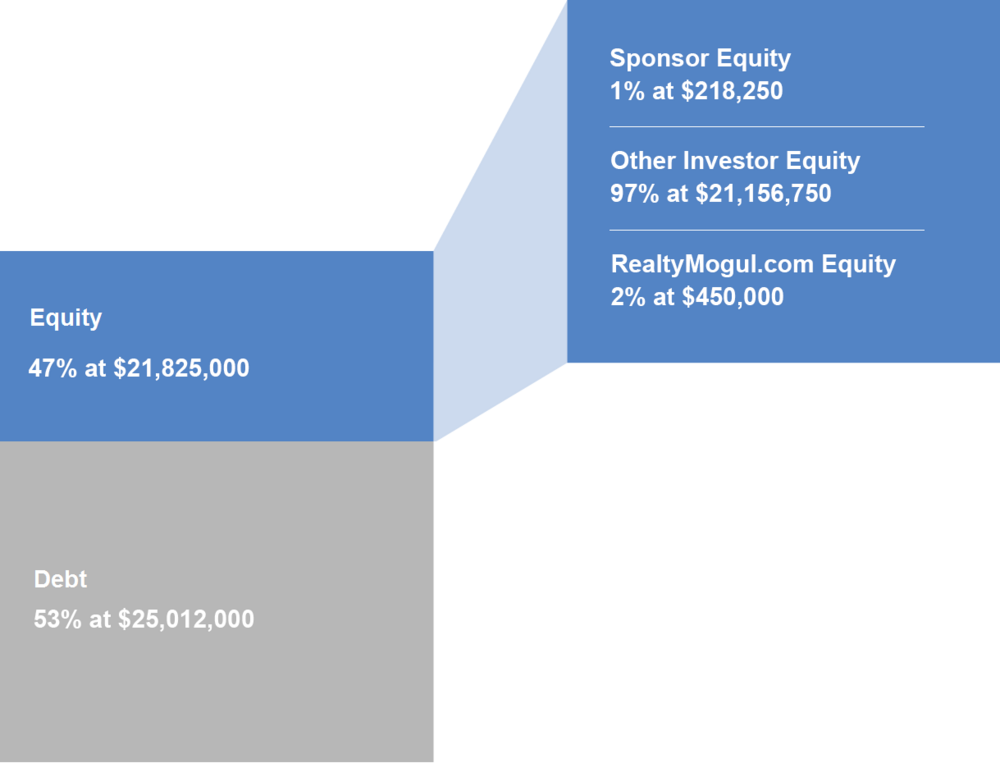

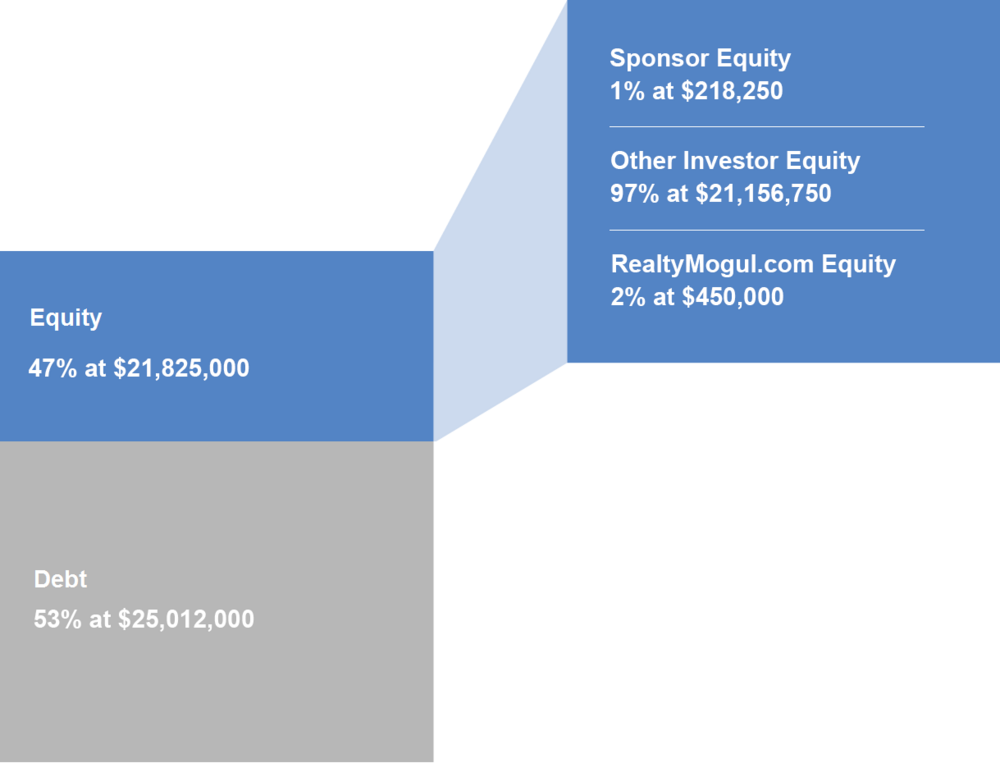

| Total Capitalization | ||

| Debt | $25,012,000 | |

| Equity | $21,825,000 | |

| Total Sources of Funds | $46,837,000 | |

| Purchase Price | $41,688,032 | |

| Acquisition Fee | $652,345 | |

| Broker-Dealer Fee and Marketing Allowance | $1,746,000 | |

| Third Party Diligence | $255,000 | |

| Syndication Costs | $95,000 | |

| Closing Costs & Other Fees | $1,432,396 | |

| Organizational & Offering Costs | $327,375 | |

| Marketing, Distribution & Sponsorship Cost | $109,125 | |

| Reserves | $531,727 | |

| Total Uses of Funds | $46,837,000 | |

The Portfolio has existing debt:

- Loan Origination Date: 12/4/2015

- Lender: Barclays Bank PLC

- Loan Proceeds: $25,012,000

- Loan to Cost: 53.4%

- Interest Rate: Fixed (4.586%)

- Amortization: 10-year interest-only

- Non-recourse

- Term: 10 years

- Prepayment Penalty: Subject to Yield Maintenance fee if loan repaid before 12/4/2020

The Sponsor will make distributions directly to investors who own a beneficial interest in the DST on a prorata basis.

Distributions are projected to start for each investor within 60 days of the completion of that investors beneficial interest in the DST. Distributions are projected to continue on a monthly basis thereafter. These distributions are at the discretion of the Sponsor and made directly by the Sponsor, neither Realty Mogul Co. nor any of its affiliates have any control or discretion on the timing or amount of distributions.

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

| One-Time Fees: | ||||

|---|---|---|---|---|

| Acquisition Fee | $652,345 | Sponsor | Capitalized Equity Contribution | 2.0% of the offering amount |

| Broker-Dealer Fee | 8.0% | Broker Dealers | Capitalized Equity Contribution | Paid to North Capital(1) or other licensed broker-dealers based on the amount of equity capital raised. Surplus fees retained by sponsor. |

| Marketing & Due Diligence Fee | 1.0% | Broker Dealers | Capitalized Equity Contribution | 1.0% based on the amount of equity invested by investors through RealtyMogul.com, third-party Broker Dealers (including North Capital(1)) are entitled to additional fees based on equity they originate,surplus fees retained by Sponsor |

| Syndication Costs | $95,000 | Sponsor or Third Parties | Capitalized Equity Contribution | |

| Equity Finance Costs | $326,173 | Sponsor or Affiliates | Capitalized Equity Contribution | |

| Organizational & Offering Costs | $327,375 | Sponsor | Capitalized Equity Contribution | 1.5% of maximum offering amount |

| Redemption of Class 2 Interests | $6,523 | Sponsor | Capitalized Equity Contribution | To redeem, on a one-for-one basis, the 100 Class 2 beneficial ownership interests in the Trust issued to the Sponsor on formation of the Trust. The Class 2 interests are currently the only outstanding ownership interests in the Trust and upon the sale of the Interests, no Class 2 interests will remain outstanding |

| Real Estate Commissions | $263,740 | JRW Realty (Sponsor Affiliate) | Capitalized Equity Contribution | |

| Recurring Fees: | ||||

| Asset Management Fee | 0.45% - 1.90% of gross rental income | Manager | Operating Cash Flow | Asset Management Fee starts at 0.45% of Gross Rental Income in Year 1 and ramps up to 1.90% by Year 7 onward. Average across a 10 year hold is 1.27%. |

| Master Lease Operating Profit | N/A | Master Lessee | Operating Cash Flow | Master Lessee will retain operating revenues from the Properties that exceed the annual base rent. |

Notes:

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

The above presentation is based upon information supplied by the Sponsor or others. Realty Mogul, Co. along with its respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.

, IL - store front.jpg?itok=4EkBjYep)

, IL - store front.jpg?itok=i7hOlnFP)