Manzo Freeman Development (the "Real Estate Company” or "MFD") is a privately owned real estate development firm with offices in Burlington and Hudson, MA. The Real Estate Company is a vertically integrated real estate acquisition development and management company with a full suite of services. The MFD team is highly experienced in acquisitions, due diligence, permitting, redevelopment, construction management, property management, asset management, accounting, and leasing. The Real Estate Company leverages 40+ years of direct real estate acquisition and development experience, in depth local market knowledge, strong reputation, and track record of success. MFD believes in the true power of community building. It is the heart and soul of everything they do.

Everett Mill (the "Property") is a 508,200 gross square feet, seven-story historical mill building comprised of flex office, industrial, and ground floor retail spaces. The Property has history dating back to the early 1900s with the first known true labor strike in America starting at its front steps; the strike set off positive changes in labor laws and wages across the United States.

The Property features a diverse tenant mix with 67 tenants ranging in size from 500 square feet to over 34,000 square feet. The Property features high ceilings, large windows, original refinished wood floors, natural brick, and exposed beams. The Property is located within a 0.5 mile walk to the Lawrence MBTA, with one-hour commute to Downtown Boston. The Property's main entrance is the gateway to the main street in downtown Lawrence that features a wide variety of restaurants, bars, and retail amenities. The Everett Mill enjoys proximity to major employers such as Lawrence General Hospital, New Balance, Amazon and Mass Hire, as well as major educational institutions such as Cambridge College, Suffolk University, Regis College, and Lawrence Public Schools. The Property is one of the last commercial and industrial mills of scale available in the Market, as most have been re-developed into multifamily apartments. The historic appeal of the Property within the developing neighborhood location allows it to be an unique asset in the market.

Per the Real Estate Company, the Property's functional versatility is highly appealing to a variety of tenants affording the Property multiple options to maximize operating income and value. The rent roll is durable with the largest tenants showing an average lease tenure of 10 years, some of which have been at the Property for 20-25 years.

Rent Roll Summary as of January 1, 2021:

| Tenant | Square Feet | % of Total | Rent ($/SF) | Lease Start | Lease Expiration |

| National Fiber Technology | 34,280 | 8.0% | $4.12 | 9/1/2012 | 8/31/2024 |

| Phoenix Charter Academy Lawrence | 28,000 | 6.5% | $13.12 | 8/1/2013 | 7/31/2023 |

| Vineyard Vines | 20,000 | 4.7% | $2.77 | 1/1/2016 | 12/31/2023 |

| Affordable Computer Tech | 17,658 | 4.1% | $4.00 | 1/1/1995 | 12/31/2021 |

| Valentine & Kebartas | 17,000 | 4.0% | $10.00 | 7/1/2001 | 8/31/2021 |

| Inventory Management | 16,800 | 3.9% | $5.30 | 5/1/2005 | 11/30/2023 |

| Canal Street Antiques | 16,684 | 3.9% | $6.50 | 5/1/2016 | 4/30/2022 |

| Southwick Social Ventures | 12,000 | 2.8% | $8.50 | 9/1/2020 | 8/31/2023 |

| Youth Development Org | 11,070 | 2.6% | $5.79 | 7/1/2013 | 6/30/2021 |

| Onyx Spectrum | 10,140 | 2.4% | $6.50 | 12/1/2015 | 11/30/2021 |

| New Balance Warehouse | 10,000 | 2.3% | $4.30 | 1/1/2013 | 12/31/2022 |

| Mid Size Tenants (2k-10k SF) | 121,089 | 28.2% | $7.90 | Varies | Varies |

| Small Tenants (<2k SF) | 30,592 | 7.1% | $7.42 | Varies | Varies |

| Vacant | 84,738 | 19.7% | N/A | N/A | N/A |

| Total/Averages | 430,051 | 100% | $7.13 |

The rent roll was provided by Manzo Freeman Development and has not been independently audited by RealtyMogul or its affiliates. Please refer to Manzo Freeman Development's materials to see the full rent roll details.

| 250 Merrimack St. | 360 Merrimack St. | 60 Island St. | One Canal St. | 290 Merrimack St. | 599 Canal St. | Averages | Subject (Post-Reno Rents) | |

|---|---|---|---|---|---|---|---|---|

| Rentable Sq. Ft. | 400,000 | 478,250 | 147,000 | 112,000 | 55,540 | 89,000 | 213,632 | 430,051 |

| Comp Type | Office | Office | Office | Office | Retail | Industrial | Flex | |

| Market Rent ($/SF) | $20 | $17-18 | $20 | $15 | $16 (NNN) | $8.40-$8.76 | $12-14 Office, $7.25 Industrial, $15 Retail | |

| Occupancy | 100% | 99% | 97% | 92% | 93% | 87% | 94.7% | 80.3% (89.5% stabilized) |

| Location | Lawrence, MA | Lawrence, MA | Lawrence, MA | Lawrence, MA | Lawrence, MA | Lawrence, MA | Lawrence, MA |

| 55 S Commercial St. | 200 Homer Ave. | 970 Fellsway | 480 Pleasant St. | 86 Joy St. | Averages | Subject | |

|---|---|---|---|---|---|---|---|

| Date Sold | 12/2017 | Pending | 03/2019 | 10/2018 | 06/2020 | ||

| Sale Price | $8 million | $14 million | $25 million | $63.8 million | $25.5 million | $27.3 million | $7,050,000 |

| Building Size (SF) | 190,772 | 292,400 | 287,570 | 201,417 | 81,000 | 210,632 | 430,051 |

| $/SF | $42 | $47 | $87 | $317 | $315 | $162 | $16 |

| Occupancy | 100% | 86.5% | 79.8% | 99% | 100% | 93.1% | 80.3% |

| Location | Manchester, NH | Ashland, MA | Medford, MA | Watertown, MA | Somerville, MA | Lawrence, MA |

Sale and lease comps were obtained from Manzo Freeman Development.

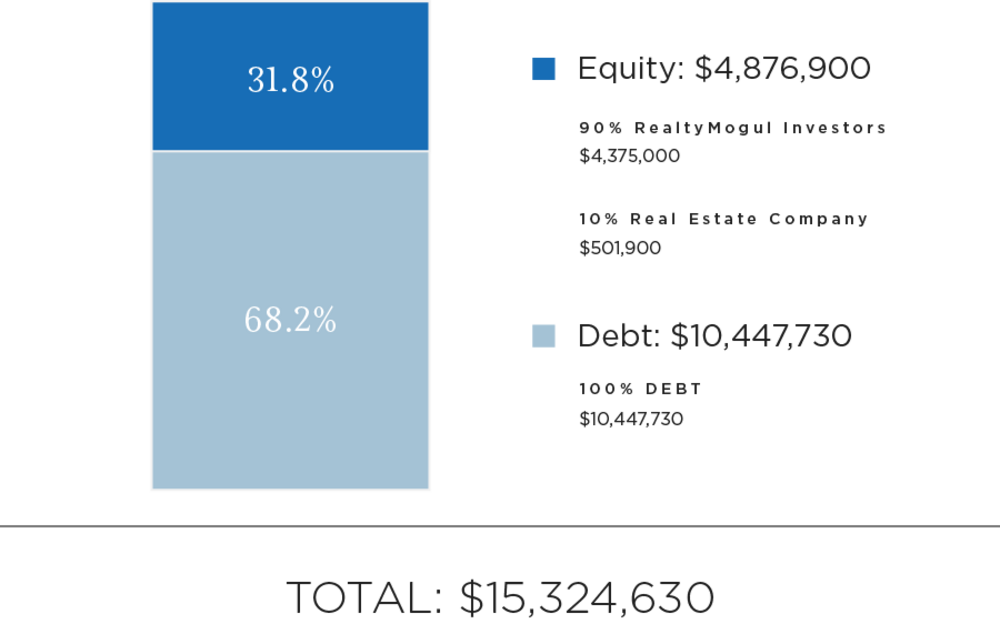

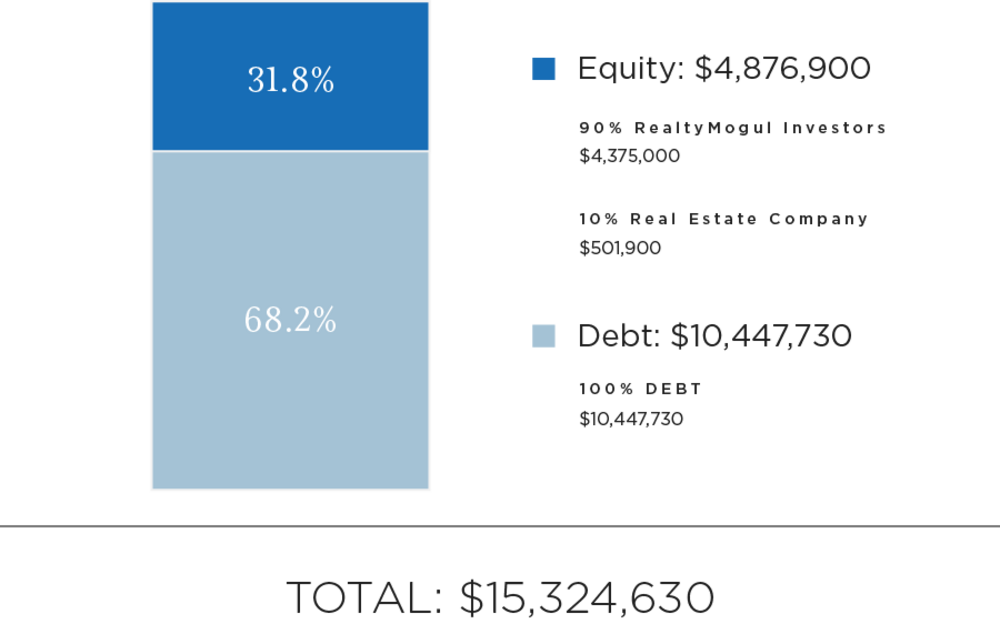

| Sources of Funds | Amount |

|---|---|

| Debt | $10,447,730 |

| Equity | $4,876,900 |

| Total Sources of Funds | $15,324,630 |

| Uses of Funds | Amount |

| Purchase Price | $7,050,000 |

| Acquisition Fee | $180,000 |

| Loan Costs | $230,000 |

| CapEx (Including Contingency) | $3,275,000 |

| Brokerage and Disposition Fees | $145,000 |

| Legal and Closing Costs(1) | $674,400 |

| Working Capital and Pre-Paid Expenses | $200,000 |

| Tenant Improvement and Leasing Commission Reserves | $3,570,230 |

| Total Uses of Funds | $15,324,630 |

Please note that Manzo Freeman Development's equity contribution may consist of friends and family equity and equity from funds controlled by Manzo Freeman Development. Additionally, the numbers represented above can change prior to closing depending on final loan proceeds, property condition assessments, appraisals, final closing costs, and other lender-mandated expenses.

(1) RM Technologies operates the RealtyMogul platform. RM Technologies charges a fixed, non-percentage-based fee for real estate companies to use the marketplace. An estimate of this fee is included in the Closing Costs and is intended to be capitalized into the transaction at the discretion of the Manager.

The expected terms of the debt financing are as follows:

- Initial Loan Amount: $3,877,500

- Future Funded Loan Amount: $6,570,230

- Total Estimated Proceeds: $10,447,730

- Estimated Annual Interest Rate (Fixed): 4.05%

- Term: 5 years

- Interest Only: 2 years

There can be no assurance that a lender will provide debt on the rates and terms noted above, or at all. All rates and terms of the debt financing are subject to lender approval, including but not limited to possible increases in capital reserve requirements for funds to be held in a lender-controlled capital reserve account.

Manzo Freeman Development intends to make distributions from EM Union Realty, LLC to EM Union Member, LLC as follows:

Operating Cash Flows:

- To the Members, pari passu, all operating cash flows to a 10.0% preferred return;

- 75% / 25% (75% to Members / 25% to Promote) of excess operating cash flows.

Capital Events:

- To the Members, pari passu, to a return of capital and a 10.0% IRR;

- 75% / 25% (75% to Members / 25% to Promote) of excess cash flows to a 16.0% IRR;

- 55% / 45% (55% to Members / 45% to Promote) of excess cash flows and appreciation thereafter.

EM Union Realty, LLC intends to make distributions to investors. Note that all distributions will occur after the payment of both company's liabilities (loan payments, operating expenses, and other fees as set forth in the LLC agreements, in addition to any member loans or returns due on member loan).

Distributions are expected to start in November 2021 and are projected to continue on a quarterly basis thereafter. These distributions are at the discretion of Manzo Freeman Development, who may decide to delay distributions for any reason, including maintenance or capital reserves. Manzo Freeman Development will receive a promote as indicated above, and a portion of this promote may be received by RM Admin, LLC for administrative services.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Effective Gross Revenue | $2,563,638 | $2,497,844 | $3,178,241 | $3,467,588 | $3,487,549 |

| Total Operating Expenses | $1,760,796 | $1,836,014 | $1,915,472 | $1,979,967 | $2,034,381 |

| Net Operating Income | $802,842 | $661,830 | $1,262,769 | $1,487,621 | $1,453,168 |

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|---|

| Investor-Level Cash Flows | ($4,375,000) | $455,044 | $334,487 | $444,981 | $608,171 | $7,037,808 |

| Net Earnings to Investor - Hypothetical $50,000 Investment | ($50,000) | $5,201 | $3,823 | $5,085 | $6,951 | $80,432 |

Certain fees and compensation will be paid over the life of the transaction; please refer to Manzo Freeman Development's materials for details. The following fees and compensation will be paid(1)(2)(3):

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Acquisition Fee | $180,000 | Manzo Freeman Development | Capitalized Equity Contribution | 2.05% of the purchase price of Everett + Stone Mills |

| Disposition Fee (Sale Brokerage Fee) | $70,000 | Manzo Freeman Development | Capitalized Equity Contribution | 4.0% of sale price of Stone Mill |

| Construction Management Fee | $142,857 | Manzo Freeman Development | Total Capitalized Contribution | 5.0% of capital improvements budget |

| Leasing Commissions | $0.75 to $1.25/SF leased | Manzo Freeman Development | Total Capitalized Contribution and Distributable Cash | Earned as new leases are signed and future funded by debt |

| Type of Fee | Amount of Fee | Received By | Paid From |

|---|---|---|---|

| Administrative Services Fee | 1.0% of amount invested into EM Union Member, LLC | RM Admin(3) | Distributable Cash |

| Asset Management Fee | 1.0% of amount invested into EM Union Member, LLC | Manzo Freeman Development | Distributable Cash |

| Property Management Fee | 4.0% of Effective Gross Income | Manzo Freeman Development | Distributable Cash |

(1) Fees may be deferred to reduce impact to investor distributions

(2) RM Technologies operates the RealtyMogul platform. RM Technologies charges a fixed, non-percentage-based fee for real estate companies to use the marketplace. An estimate of this fee is included in the Closing Costs and is intended to be capitalized into the transaction at the discretion of the Manager.

(3) RM Admin will be providing the following services:(a) responding to inbound investor inquiries regarding how to subscribe to the Project, (b) distribution of all annual tax forms (after receipt of same from Project Sponsor), (c) processing distributions that are payable from EM Union Member, LLC to Investors, however, RM Admin will not be deemed to have custody of client funds, (d) distribution of all quarterly reports (after receipt of same from Project Sponsor) and (e) summarizing sponsor information on property performance, responding to investor inquiries regarding sponsor performance information as well as the real estate market generally.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.