Clear Height Properties ("Clear Height") is a real estate investment and management company headquartered in Chicago, Illinois. The company’s vision is to create value for its clients through acquiring and developing properties in the most desirable locations. From the beginning Clear Height has been driven by the belief that, “the work they do is a reflection of who they are.” That belief is what guides them in providing a transparent, dependable and entrepreneurial atmosphere for their team members, clients, and partners.

Acquisition

Clear Height, along with its partners, has developed a system designed to handle all aspects of real estate opportunities to allow for quick valuations, short due diligence, and “cash” closings. Their acumen and balance sheet gives them a competitive advantage in the market place to source the type of projects they are looking to invest in. With a heavy focus on industrial real estate opportunities, Clear Height is seeking value-add investments that are underperforming, distressed, and entrepreneurial in nature. In order to take advantage of these opportunists, they are experienced and capable of handling note purchases, build-to-suits, short-sales, portfolio sales and other opportunities.

Property Management

Clear Height’s property management group understands that each asset has its own specific financial objectives. With their approach to managing properties, they are able to provide customer service to their tenants, all while keeping a healthy bottom-line. Believing that tenant retention is the key to superb property management, their tenants have come to appreciate the high-touch they provide, and with most requests being handled within 24 hours. In addition, their team focuses on tenant relations, occupancy target levels, increased rental performance and an overall better understanding of a tenant's needs and how they compare with the owner's goals. They take this a step further with a proactive approach to lowering operating costs without sacrificing service to the tenants.

Asset Management

Clear Height’s asset management group looks to help investors receive measurable returns with their real estate holdings. Clear Height researches and evaluates the most optimal operational strategies for each asset with a focus on maximizing property values while mitigating risk. Clear Height’s track record of in-house leasing and management allows them to foster strong tenant relations that assist in maintaining occupancy levels. With Clear Height’s operational focus and expertise, they seek to control expenses and maximize efficiencies to create long-term cash flow sustainability and growth.

Leasing

Clear Height creates marketing strategies aligned with each asset's business plan that focus on obtaining and retaining the best tenants the market has to offer. They accomplish this by analyzing the local marketplace as it relates to trends, prospects, cycles and most importantly working with the brokerage community.

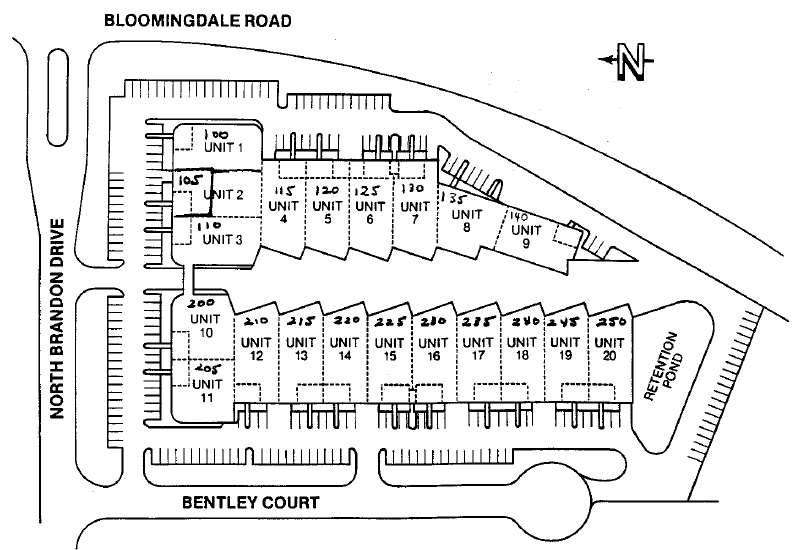

Built in 1980, this 85.5% occupied flex-industrial asset is comprised of 104,419 square feet across two buildings that have been subdivided into 16 suites ranging in size from 1,107 to 14,794 square feet. The majority of the suites contain a mix of both warehouse and office space (office build-outs range from 0-100% and average 26%). The Property is equipped with 17 exterior docks, 14 drive-in doors, has estimated clear heights of 15 feet, and features 200 surface parking spaces (1.91 spaces per 1,000 square feet). It also enjoys five access points that provide the necessary space for truck maneuverability.

| Sales Comps | ||||

| Address | Sale Date | Size (SF) | Price | $/SF |

| SFP Armitage, Addison 1 | Under Contract | 79,992 | $4,250,000 | $53 |

| 1198 Nagel Blvd., DuPage | 9/18/2015 | 131,250 | $7,937,500 | $60 |

| 6350 Church Rd., North DuPage | 6/15/2015 | 83,666 | $5,800,000 | $69 |

| 10 W. North Ave., Lombard | 3Q2015 | 118,680 | $7,863,500 | $66 |

| 999 Regency Dr., Glendale Heights | 3Q2015 | 48,663 | $3,202,000 | $66 |

| 1101 Lombard Rd. N, Lombard | 3Q2015 | 40,896 | $2,126,592 | $52 |

| Average | 83,858 | $62 | ||

| Submarket Average (since 2003) | $77 | |||

| Subject | 104,419 | $5,110,000 | $49 | |

1 The Sponsor is an owner and manager of this deal that is currently under contract to be sold

| Leasing Comps | |||||||

| Deal | Type | Size | Lease Rate | Lease Start | Term | Escalation | Abatement |

| 1032 N DuPage, Lombard | MG | 2,912 | $8.25 | 07/01/14 | 3.17 | 2.75% | 1 |

| 1040 N DuPage, Lombard | MG | 5,661 | $8.10 | 10/01/14 | 5.25 | 3.00% | 2 |

| 972 N DuPage, Lombard | MG | 2,547 | $8.25 | 08/01/14 | 2.17 | 2.50% | 0 |

| 960 N DuPage, Lombard | MG | 5,036 | $7.70 | 08/01/14 | 3.00 | 3.00% | 1 |

| 976 N DuPage, Lombard | MG | 2,553 | $8.15 | 09/01/14 | 2.00 | 3.00% | 0 |

| 1040 N DuPage, Lombard | MG | 5,661 | $8.35 | 01/01/15 | 5.25 | 2.50% | 4 |

| 1054 N DuPage, Lombard | MG | 5,133 | $8.25 | 02/01/15 | 5.25 | 2.50% | 3 |

| 974 N DuPage, Lombard | MG | 2,533 | $8.00 | 02/01/15 | 1.00 | 0.00% | 0 |

| 1034 N DuPage, Lombard | MG | 5,117 | $8.25 | 05/01/15 | 1.00 | 0.00% | 0 |

| 980 N DuPage, Lombard | MG | 5,036 | $8.95 | 09/01/15 | 5.08 | 3.00% | 1 |

| Average | MG | 4,219 | $8.24 | 3.32 | 2.78% | 1.20 | |

| Subject - In Place | MG | 6,526 | $6.88 | 3.20 | |||

| Subject - Projected 1 | MG | 6,526 | $7.88 | 5.00 | 2.50% | 0.00 | |

1 Weighted average for new and renewal leases within the first 24 months

The comparables included in the above tables were either sourced from CoStar or Real Capital Analytics, or they were provided by the Sponsor

| Total Capitalization | ||

| Debt | $3,729,959 | |

| Equity | $1,951,993 | |

| Total Sources of Funds | $5,681,952 | |

| Purchase Price | $5,110,000 | |

| Acquisition Fee | $127,750 | |

| Broker-Dealer Fee | $40,000 | |

| CapEx, TI, LC | $226,728 | |

| Working Capital | $100,000 | |

| Closing Costs & Other Fees | $77,473 | |

| Total Uses of Funds | $5,681,952 | |

The projected terms of the debt financing are as follows:

- Lender: First Community Financial Bank

- Estimated Proceeds: $3,729,959, of which $152,959 to be reserved for capital improvements and leasing costs

- Estimated Rate: Fixed (4.25%)

- Amortization: 25 years, with two years of interest-only

- Term: 5 years

- Prepayment Penalty: While there will be no prepayment penalty if the Property is sold to an unrelated third party, the loan will contain a 3/2/1/1/1 prepayment penalty if the loan is refinanced at another financial institution, with the last six months of the loan term being at par.

There can be no assurance that a lender will provide debt on the rates and terms noted above, or at all. All rates and terms of the debt financing are subject to lender approval, including but not limited to possible increases in capital reserve requirements for funds to be held in a lender controlled capital reserve account.

CHP Bloomingdale Real Estate, LLC will make distributions to Realty Mogul 58, LLC as follows: pro rata share of cash flow to a 10% Internal Rate of Return ("IRR") hurdle, with a 70/30 split thereafter (70% to members, 30% to Sponsor) of excess cash flows and appreciation. Realty Mogul 58, LLC will distribute 100% of its share of excess cash flow (after expenses) to the members of Realty Mogul 58, LLC (the RealtyMogul.com investors). The manager of Realty Mogul 58, LLC will receive a portion (up to 10%) of the Sponsor's promote interest.

Order of Distributions to Realty Mogul 58, LLC (Operating Income, Refinance, and Sales Proceeds)

- To all members pari passu until contributions have been returned and members have received a 10% IRR

- Any excess balance will be split 70% to members pari passu and 30% to Sponsor

Distributions are projected to start in September 2016 and are projected to continue on a quarterly basis thereafter. These distributions are at the discretion of the Sponsor, who may decide to delay distributions for any reason, including maintenance or capital reserves.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Effective Gross Revenue | $627,680 | $737,726 | $791,251 | $846,530 | $876,563 |

| Total Operating Expenses | $272,835 | $286,363 | $293,521 | $305,989 | $312,647 |

| Net Operating Income | $354,845 | $451,363 | $497,730 | $540,541 | $563,916 |

| Distributions to Realty Mogul 58, LLC Investors | $76,708 | $77,617 | $78,578 | $79,240 | $106,427 |

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

| One-Time Fees: | ||||

|---|---|---|---|---|

| Acquisition Fee | $127,750 | Sponsor | Capitalized Equity Contribution | 2.5% of the property purchase price |

| Broker-Dealer Fee | The greater of 4.0% or $40,000 | North Capital (1) | Capitalized Equity Contribution | 4.0% based on the amount of equity invested by Realty Mogul 58, LLC |

| Legal Expense Fee | $10,000 | North Capital | Capitalized Equity Contribution | |

| Recurring Fees: | ||||

| Property Management Fee | 4.0% of effective gross revenues | SFP Commercial Real Estate, LLC, an affiliate of the Sponsor | Operating Cash Flow | |

| Asset Management Fee | 1.0% of effective gross revenues | Sponsor | Operating Cash Flow | |

| Management and Administrative Fee | 1.5% of amount invested in Realty Mogul 58, LLC | RM Manager, LLC | Distributable Cash | RM Manager, LLC is the Manager of Realty Mogul 58, LLC and a wholly-owned subsidiary of Realty Mogul, Co. (2) |

Notes:

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

(2) Fees may be deferred to reduce impact to investor distributions

The above presentation is based upon information supplied by the Sponsor or others. Realty Mogul, Co., RM Manager, LLC, and Realty Mogul 58, LLC, along with their respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Sponsor is obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.