The team at our affiliated broker-dealer, RM Securities, conducts diligence on of the issuer, including detailed background checks, criminal checks, bad actor checks, and reference checks on sponsors. In addition to screening for any criminal background, we may also turn down sponsors due to poor reference checks, even if the background and criminal checks are satisfactory.

We require unaffiliated sponsors to use an unaffiliated third-party escrow agent.* When an investor makes an investment with such sponsors using the RealtyMogul platform, the investor’s money is transferred directly into a third-party escrow account. All closing conditions in connection with a sponsor’s contingency offering need to be met before the third-party escrow agent will approve releasing investor funds to the issuer or general partner. For example, if an issuer or general partner plans to use funds for a real estate acquisition that does not ultimately transact, the third-party escrow agent will not transfer investor funds to the issuer or general partner, and funds will be returned to investors.

* Unless otherwise disclosed, escrow accounts are not required for some investments that accommodate 1031 investments where the property is already acquired.

Our processes typically includes visiting certain properties (or a subset of properties if it's a fund) to confirm the real estate is what and where the real estate is supposed to be. For certain properties that accommodate 1031 exchange investments, the team will review third-party prepared due diligence reports in lieu of a site visit.

We have formalized processes and checklists for every private placement deal listed on the platform.

With in-place rents below that of comps, the Property offers significant rental upside via mark-to-market as well as additional renovation potential (10% above in-place). Even after a $10 million renovation budget, proforma rents are still under post-renovated comparable rents by 6%.

The Real Estate Company is highly experienced and acquires properties exclusively in the Washington D.C. area, with over $400 million in multifamily assets acquired and renovated since formation. Because the Principal also owns a construction company, he is able to reduce costs by sourcing materials directly from abroad.

The Property is seven miles from Amazon's proposed HQ2, which is now the sole location since the company cancelled its plans for a second site in Long Island City, NY. Per CoStar and Business Insider, the campus is expected to span 4.1 million square feet and provide 25,000 new jobs at an average salary of $150,000 over the course of 15 years.

Dragone Realty Investments

Dragone Realty Investments (the "Real Estate Company”) is a real estate company that specializes in the acquisition, renovation, and management of multifamily assets in the Washington D.C. Metro. The Real Estate Company is run by President and Founder Vito Dragone, who launched his career at Oxford Realty Financial Group before running acquisitions for ROSS Companies. Since starting the Real Estate Company in 2007, Mr. Dragone has acquired and renovated over $400 million in multifamily assets. Mr. Dragone also owns a construction company which has executed $100 million in renovations over the past 10 years.

https://www.dragonerealty.com/| Property | Location | Asset Type | Acquisition Date | Units | Purchase Price | Sale Price/ Market Value |

|---|---|---|---|---|---|---|

| Unrealized | ||||||

| The Milano | Oxon Hill, MD | Multifamily | 11/30/2010 | 305 | $10,000,000 | $47,275,000 |

| Verona at Silver Hill | Suitland, MD | Multifamily | 2/22/2007 | 214 | $17,426,000 | $37,450,000 |

| Verona at District Heights | District Heights, MD | Multifamily | 3/27/2019 | 404 | $47,500,000 | $70,700,000 |

| Verona at the Park | Capital Heights, MD | Multifamily | 12/21/2016 | 272 | $24,285,000 | $42,160,000 |

| Lynnhill Apartments | Temple Hills, MD | Multifamily | 3/15/2018 | 219 | $17,050,000 | $43,800,000 |

| Realized | ||||||

| Avanti | District Heights, MD | Multifamily | 7/19/2012 | 930 | $58,000,000 | $131,000,000 |

| Verona at Landover Hills | Landover Hills, MD | Multifamily | 2/27/2015 | 727 | $63,000,000 | $104,050,000 |

| Total | 3,071 | $237,261,000 | $471,885,000 | |||

The Real Estate Company's bio and track record were provided by the Real Estate Company and have not been verified by RealtyMogul or affiliates.

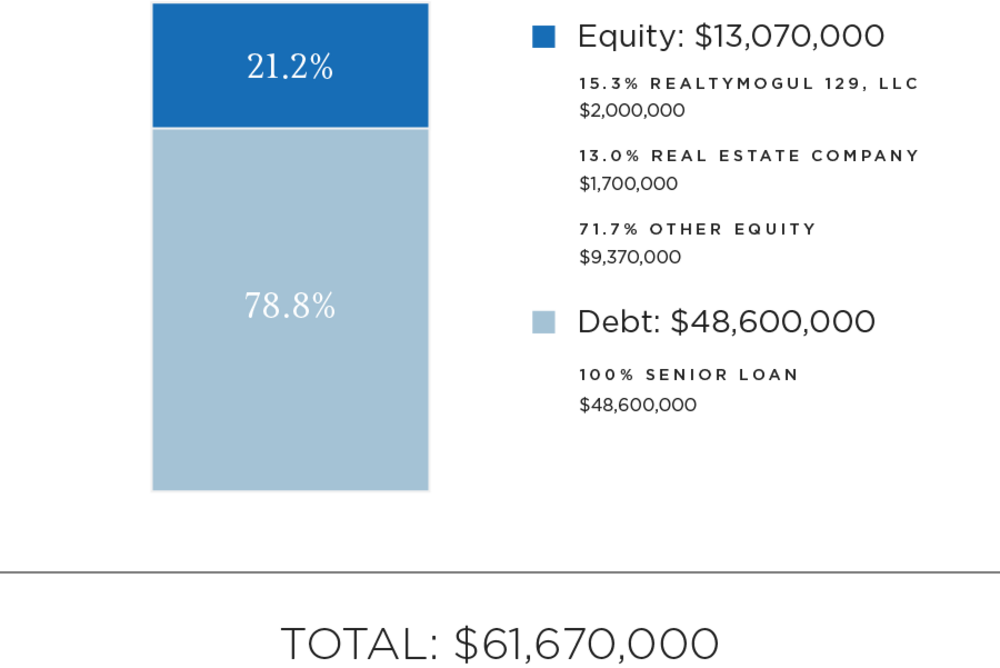

In this transaction, RealtyMogul investors are to invest in RealtyMogul 129, LLC ("The Company"), which is to subsequently invest in District Heights Fund I, LLC ("The Target"), a limited liability company that will indirectly own interest in the Property. Dragone Realty Investments (the "Real Estate Company") is under contract to purchase the Property for $47.5 million ($117,574 per unit) and the total project cost is expected to be $61.7 million ($152,649 per unit).

The Real Estate Company plans to implement a value-add strategy, in which it will capitalize $10.1 million ($25,070 per unit) to renovate the Property. $5.9 million ($14,556 per unit) has been budgeted for interior unit upgrades which include new cabinets, appliances, granite countertops, vinyl-plank flooring in the kitchens and ceramic in the baths, carpet, two-tone paint with texture, two-panel interior doors, new baseboard molding, upgraded LED lighting fixtures, bathroom vanities with granite, upgraded plumbing fixtures, and new bathtubs and toilets with new ceramic tub surrounds. The interior renovation budget also includes the addition of showers in all 54 half-baths to make them full-baths, and the conversion of the 'den' area of 58 of the two-bedroom floorplans to make them three-bedroom plans. Additionally, $3.1 million has been budgeted for exterior improvements including building hallway upgrades with ceramic tile, resealing and striping the parking lots, upgraded LED lighting, new signage, landscaping, fencing, roof replacements as needed, pool house renovation and new pool furniture, replacing all of the fire hydrants and water supply lines, remodeling the laundry rooms with ceramic tile, painting all of the buildings, new canopies, adding a new fitness center, and controlled access gate at the entrance to the property. Upon stabilization, the Real Estate Company expects to achieve net effective rents of $1,382 per unit, which represents a 10% premium over in-place rents but a 6% discount to the post-reno comps' average rent, according to Axiometrics. The business plan calls for a four year hold, at which point the Property will be sold at a 6.00% cap rate.

Below is a summary of the capital improvements budget:

| CapEx Item | $ Amount | Per Unit |

|---|---|---|

| Interior Unit Renovations | $5,880,600 | $14,556 |

| Exterior Renovations | ||

| HVAC Condensation Line Repairs | $101,000 | $250 |

| Underground Pipe Repairs (Dig-ups) | $50,000 | $124 |

| Fire Hydrant | $400,000 | $990 |

| Balcony | $141,400 | $350 |

| Hallways | $190,000 | $470 |

| Unit Door Upgrades | $111,100 | $275 |

| Laundry Upgrades | $112,200 | $278 |

| Storage Room Upgrades | $69,000 | $171 |

| Building Shell Improvements | $534,000 | $1,322 |

| Canopies | $114,000 | $282 |

| Window Repairs/Improvements | $186,800 | $462 |

| Parking Lot (Seal & Stripe) | $125,000 | $309 |

| Exterior Lighting | $85,000 | $210 |

| Landscaping | $121,200 | $300 |

| Drainage | $40,400 | $100 |

| Concrete | $35,000 | $87 |

| Trash Enclosures | $30,000 | $74 |

| Fencing and Signage | $90,000 | $223 |

| Maintenance/Leasing Golf Carts | $10,000 | $25 |

| Permits | $60,600 | $150 |

| Dumpsters | $181,800 | $450 |

| Pool Area Renovations | $100,000 | $248 |

| Fitness Center | $95,000 | $235 |

| Controlled Access Gate at Entrance | $60,000 | $149 |

| Office Renovation | $50,000 | $124 |

| Rebranding Marketing & Collateral | $25,000 | $62 |

| Model Furniture | $25,000 | $62 |

| Total Exterior Improvements | $3,143,500 | $7,781 |

| General Requirements | ||

| Supervision | $253,750 | $628 |

| Security | $100,000 | $248 |

| Total General Requirements | $353,750 | $876 |

| Contingency 3.0% | $281,336 | $696 |

| Construction Management Fee 5.0% | $468,893 | $1,161 |

| Total | $10,128,078 | $25,070 |

Built in 1963, Verona at District Heights f.k.a. Pennbrooke Station Apartments (the “Property”) is a 404-unit apartment community comprised of one-bedroom (95 units), two-bedroom (285 units), and three-bedroom (24 units) floorplans situated on 18 acres in the Suitland/District Heights/Capitol Heights submarket of the Washington-Arlington-Alexandria MSA. Currently 92% occupied, the Property includes a dog park, playground, pool, and laundry facilities. It is immediately adjacent to Pennsylvania Avenue and 2.7 miles from Route 495. The Property is 7.3 miles from Downtown Washington D.C., 6.8 miles from Ronald Reagan Washington National Airport, and 6.4 miles from the MGM National Harbor Casino and Resort (a $1.5 billion development which opened in 2016 and brought 2,500 jobs to the area). The Property is also only 7.4 miles from Amazon's new HQ2 location in Crystal City, VA. Per CoStar, the new location is projected to bring 25,000 new jobs to the area over the course of 15 years. Within one mile of the Property, there is an ALDI, Marshalls, CVS, Rite Aid, Wells Fargo, Planet Fitness, and several retail and dining options. The Suitland Federal Center and adjacent Town Square redevelopment project are 0.6 miles from the Property.

| Unit Type (In-Place) | Unit Type (Stabilized) | # of Units | % of Total | Unit (Square Feet) | In-Place Rent | Post-Reno Rent |

|---|---|---|---|---|---|---|

| 1/1 Jr | 1/1 Jr | 1 | 0% | 700 | $1,060 | $1,182 |

| 1/1 | 1/1 | 94 | 23% | 770 | $1,099 | $1,257 |

| 2/1 Jr | 2/1 Jr | 52 | 13% | 860 | $1,178 | $1,292 |

| 2/1 | 2/1 | 160 | 40% | 935 | $1,256 | $1,381 |

| 2/1.5 | 2/2 | 15 | 4% | 935 | $1,340 | $1,446 |

| 2/1 Den | 3/1 | 43 | 11% | 1,033 | $1,392 | $1,505 |

| 2/1.5 Den | 3/2 | 15 | 4% | 1,033 | $1,438 | $1,530 |

| 3/1.5 Den | 3/2 Den | 24 | 6% | 1,150 | $1,574 | $1,729 |

| Totals/Averages | 404 | 100% | 913 | $1,252 | $1,382 | |

All rents are net effective

Lease Comparables

| Ashton Heights | Park Greene Apartments | Verona at Silver Hills | Whitehall Square | Averages | Subject (Post-Reno) | |

| # of Units | 280 | 349 | 214 | 584 | 357 | 404 |

| Year Built | 1974 | 1962 | 1968 | 1973 | 1969 | 1963 |

| Average SF | 982 | 669 | 988 | 1015 | 914 | 913 |

| Average Rental Rate | $1,522 | $1,395 | $1,433 | $1,535 | $1,471 | $1,382 |

| Distance from Subject | 1.9 miles | 0.9 miles | 1.5 miles | 1.3 miles | 1.4 miles | -- |

All rents are net effective

Sale Comparables

| The District | Princeton Estates | Marlow Garden | Raleigh Court | Averages | Subject | |

| Date | Oct '18 | Oct '17 | Feb '18 | Jun '18 | -- | -- |

| Year Built | 1966 | 1962 | 1960 | 1964 | 1963 | 1963 |

| # of Units | 427 | 474 | 256 | 99 | 314 | 404 |

| Purchase Price | $59,750,000 | $55,500,000 | $26,900,000 | $11,000,000 | $38,287,500 | $47,500,000 |

| $/Unit | $139,930 | $117,089 | $105,078 | $111,111 | $118,302 | $117,574 |

| Cap Rate | 6.00% | -- | -- | 6.00% | 6.00% | 6.74% |

| Distance from Subject | 1.7 miles | 2.6 miles | 2.1 miles | 2.8 miles | 2.3 miles | -- |

Sale and lease comps were obtained from CoStar and Axiometrics

Market Overview

Per CoStar, the long-term potential across the Washington D.C. market is enormous, with Amazon CEO Jeff Bezos announcing that Crystal City would be the sole location for Amazon's new HQ2. Over the course of 15 years, the company is expected to hire 25,000 employees at the site at an average wage of $150,000. This move will likely keep multifamily construction, demand, and occupancy up for the foreseeable future. Even before the Amazon announcement, Washington D.C. was undergoing one of the largest multifamily expansions in the country (ranking only behind New York and Dallas-Fort Worth for the most units built this cycle). Despite this, the vacancy rate has held firm in most of the metro due to costly homeownership, strong renter household formation, and a healthy job market.

Per Axiometrics, effective rent decreased 0.8% from $1,747 in 3Q18 to $1,733 in 4Q18; even so, annual effective rent growth was 1.6% in 2018. Annual effective rent growth is forecast to be 2.4% in 2019, and average 2.0% from 2020 to 2022. Annual effective rent growth has averaged 3.0% since 1Q95. The market's annual rent growth rate was above the national average of 2.5%. The market's occupancy rate decreased from 96.0% in 3Q18 to 95.5% in 4Q18, and was up from 95.2% a year ago. For the forecast period, the market's occupancy rate is expected to be 95.4% in 2019, and average 94.9% from 2020 to 2022. The market's occupancy rate has averaged 95.6% since 1Q95.

Submarket Overview

Per CoStar, the D.C. Metro's job centers are accessible from the submarket via Metro's green line, I-495, and Branch and Pennsylvania Avenues, which drove a decline in submarket vacancies in 2015 and 2016. The local job market consists primarily of state government entities and lower-paying retail employment, which explains why the submarket has one of the metro's lower median household incomes. The General Services Admission (GSA) selected this submarket for the new U.S. Citizenship and Immigration Services headquarters, which is expected to bring about 3,700 employees when the agency moves in 2019 and should lift the local demographics.

In November 2017, construction began on Town Square at Suitland Federal Center, which is set to be the largest redevelopment project in Prince George's County history and only 0.6 miles from the Property. The one-million-square-foot mixed-use development will include nearly 900 apartments and single family homes, 100,000 square feet of retail space, and a 50,000-square-foot performing arts center. The project will be completed in three phases and is expected to create 1,200 construction jobs.

Per Axiometrics, effective rent decreased 0.2% from $1,372 in 3Q18 to $1,370 in 4Q18. The submarket's annual rent growth rate of 3.0% was above the market average of 1.6% in 2018. Annual effective rent growth is forecast to be 3.3% in 2019, and average 2.9% from 2020 to 2022. The annual effective rent growth has averaged 3.1% per year since 2Q01. The submarket's occupancy rate decreased from 95.6% in 3Q18 to 94.5% in 4Q18, and was down from 95.1% a year ago. The submarket's occupancy rate was below the market average of 95.5% in 4Q18. For the forecast period, the submarket's occupancy rate is expected to decrease slightly to 94.2% in 2019 and average 93.8% from 2020 to 2022. The submarket's occupancy rate has averaged 94.8% since 2Q98.

Demographic Information

Demographic Information

| 1 Mile | 3 Miles | 5 Miles | |

|---|---|---|---|

| Population (2018) | 20,962 | 167,643 | 412,301 |

| Population (2023) | 21,426 | 174,782 | 433,229 |

| Average Age | 36 | 37 | 36 |

| Median Household Income | $58,830 | $57,589 | $56,040 |

| Average Household Size | 2.4 | 2.5 | 2.5 |

| Median Home Value | $211,822 | $240,217 | $260,949 |

| Population Growth 2018-2023 | 2.21% | 4.26% | 5.08% |

Demographic information above was obtained from CoStar.

| Sources of Funds | Cost |

|---|---|

| Debt | $48,600,000 |

| Equity | $13,070,000 |

| Total Sources of Funds | $61,670,000 |

| Uses of Funds | Cost |

| Purchase Price | $47,500,000 |

| Real Estate Company Acquisition Fee | $500,000 |

| Warren Private Clients Acquisition Fee | $350,000 |

| Broker Dealer Fee | $80,000 |

| Loan Fee | $729,000 |

| CapEx Budget | $10,128,078 |

| Interest Rate Cap | $100,000 |

| Working Capital | $250,000 |

| Closing Costs | $1,100,800 |

| Escrows | $932,122 |

| Total Uses of Funds | $61,670,000 |

A portion of Real Estate Company equity may come from family and friends

The expected terms of the debt financing are as follows:

- Lender: PCCP

- Estimated Proceeds: $48,600,000

- Estimated Rate (Floating): One Month Libor plus 3.35%

- Amortization: 30 years

- Term: 4 years

- Interest Only: 4 years

- Prepayment Penalty: None

- Extension Options: One one-year extension option (0.25% fee)

There can be no assurance that a lender will provide debt on the rates and terms noted above, or at all. All rates and terms of the debt financing are subject to lender approval, including but not limited to possible increases in capital reserve requirements for funds to be held in a lender controlled capital reserve account.

The Target will make distributions to investors (The Company and Real Estate Company, collectively, the "Members") as follows:

Operating Income, Refinance, and Sales Proceeds

First Waterfall:

- To the Members, pari passu, all excess operating cash flows to a 10.0% IRR to the Members;

- 90.0% / 10.0% (90.0% to Members / 10.0% to Real Estate Company) of excess cash flow and appreciation thereafter.

Second Waterfall:

- 100% to RealtyMogul 129, LLC investors to an 8.0% IRR;

- 70.0% / 30.0% (70.0% to RealtyMogul 129, LLC investors / 30.0% to RM Manager) of excess operating cash flows to a 12.0% IRR;

- 60.0% / 40.0% (60.0% to RealtyMogul 129, LLC investors / 40.0% to RM Manager) of excess cash flow and appreciation thereafter.

Note that these distributions will occur after the payment of the Company's liabilities (loan payments, operating expenses and other fees as set forth in the LLC agreement, in addition to any member loans or returns due on member loans).

The manager of The Company may receive a portion of the promote. Distributions are expected to start in September 2019 and are projected to continue on a quarterly basis thereafter. These distributions are at the discretion of the Real Estate Company, who may decide to delay distributions for any reason, including maintenance or capital reserves.

| Year 1 | Year 2 | Year 3 | Year 4 | |

|---|---|---|---|---|

| Effective Gross Revenue | $5,984,219 | $6,352,691 | $7,000,692 | $7,387,170 |

| Total Operating Expenses | $2,784,081 | $2,880,446 | $2,987,114 | $3,078,388 |

| Net Operating Income | $3,200,138 | $3,472,245 | $4,013,578 | $4,308,782 |

| Year 0 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Distributions to RealtyMogul 129, LLC Investors | ($2,020,000) | $55,847 | $59,912 | $120,637 | $175,196 | $3,125,352 |

| Net Earnings to Investor - Hypothetical $50,000 Investment |

($50,000) | $1,382 | $1,483 | $2,986 | $4,337 | $77,360 |

Certain fees and compensation will be paid over the life of the transaction. The following fees and compensation will be paid:

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Acquisition Fee | $500,000 | Real Estate Company | Capitalized Equity Contribution | 1.05% of the Property purchase price |

| Acquisition Fee | $350,000 | Warren Private Clients | Capitalized Equity Contribution | 0.74% of the Property purchase price |

| Broker-Dealer Fee | $80,000 | North Capital | Capitalized Equity Contribution | Greater of $50,000 and 4.0% of the equity raised by RealtyMogul 129, LLC |

| Construction Management Fee | 5.0% of costs | Real Estate Company | Capitalized Equity Contribution | |

| Disposition Fee | $400,000 | Warren Private Clients | Distributable Cash | Fee is subordinate to a full return of equity |

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Management and Administrative Fee | 1.25% of amount invested in RealtyMogul 129, LLC | RM Manager, LLC | Distributable Cash | RM Manager, LLC is the Manager of RealtyMogul 129, LLC and a wholly-owned subsidiary of Realty Mogul, Co. (2) |

| Asset Management Fee | 1.0% of Effective Gross Income | Real Estate Company | Distributable Cash | Subject to $5,000 per month minimum |

| Asset Management Fee | $30,000 per year | Warren Private Clients | Distributable Cash | Fee is subject to 3% annual increases |

| Property Management Fee | 3.0% of Effective Gross Income | WestCorp Management Group | Distributable Cash |

(1) Certain employees of Realty Mogul, Co. are registered representatives of, and are paid commissions by, North Capital Private Securities Corp., a Delaware corporation ("North Capital"). In addition, North Capital pays a technology provider services fee to Realty Mogul, Co. for licensing and access to certain technology, reporting, communications, branding, entity formation and administrative services performed from time to time by Realty Mogul, Co., and North Capital and Realty Mogul, Co. are parties to a profit sharing arrangement.

(2) Fees may be deferred to reduce impact to investor distributions.

The above presentation is based upon information supplied by the Real Estate Company or others. Realty Mogul, Co., RM Manager, LLC, and The Company, along with their respective affiliates, officers, directors or representatives (the "RM Parties") hereby advise you that none of them has independently confirmed or verified any of the information contained herein. The RM Parties further make no representations as to the accuracy or completeness of any such information and undertake no obligation now or in the future to update or correct this presentation or any information contained herein.

RM Securities, LLC, its registered representatives, affiliates, associated persons, and personnel of its affiliates who may also be associated with it, including our associated persons and personnel of our affiliates who are also be associated with RM Securities, LLC (it (“RM Securities,” “we,” “our,” or “us”) will receive fees, expense reimbursements, and other compensation (“Fees”) from the issuer of this investment offering, its sponsor, or an affiliate thereof (“Sponsor”), or otherwise in connection with Sponsor’s offering. The Fees paid to us are in addition to other fees you will pay to Sponsor or in connection with Sponsor’s investment offering. You will pay Fees to Sponsor, either directly or indirectly as an investor in the Sponsor’s offering. Sponsor will use the Fees you pay, as well as funds you invest in the relevant offering, to compensate us. The Fees paid to us will directly or indirectly be borne by you as the investor (typically, but not always, in the form of an expense of the Sponsor’s offering in which you invest) because such Fees will reduce the proceeds available for distribution to you and reduce the amount you earn over time.

For more information on the Fees paid to us, or any other Fees you will pay in connection with Sponsor’s offering, please carefully review the Sponsor’s Investment Documents. Please also carefully review RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

No Approval, Opinion or Representation, or Warranty by RM Securities, LLCSponsor has provided, approved, and is solely responsible in all aspects for the information on this webpage (“Page”), including Sponsor’s offering documentation, which may include without limitation the Private Placement Memorandum, Operating or Limited Partnership Agreement, Subscription Agreement, the Project Summary and all exhibits and other documents attached thereto or referenced therein (collectively, the “Investment Documents”). The Investment Documents linked on this page have been prepared and posted by Sponsor, and not by RM Securities. We did not assist in preparing, do not adopt or endorse, and we are not otherwise responsible for, the Sponsor’s Investment Documents. We make no representations or warranties as to the accuracy of information on this Page or in the Sponsor’s Investment Documents and we accept no liability therefor. No part of the information on this Page or in the Sponsor’s Investment Documents is intended to be binding on us.

Sponsor’s Information Qualified by Investment DocumentsThe information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Neither RM Securities nor Sponsor are obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments. For additional information on RM Securities’ involvement in this offering, please carefully review the Sponsor’s Investment Documents, and RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. RM Securities and its affiliates make no representation or warranty of any kind with respect to the tax consequences of your investment or that the IRS will not challenge any such treatment. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.