The team at our affiliated broker-dealer, RM Securities, conducts diligence on of the issuer, including detailed background checks, criminal checks, bad actor checks, and reference checks on sponsors. In addition to screening for any criminal background, we may also turn down sponsors due to poor reference checks, even if the background and criminal checks are satisfactory.

We require unaffiliated sponsors to use an unaffiliated third-party escrow agent.* When an investor makes an investment with such sponsors using the RealtyMogul platform, the investor’s money is transferred directly into a third-party escrow account. All closing conditions in connection with a sponsor’s contingency offering need to be met before the third-party escrow agent will approve releasing investor funds to the issuer or general partner. For example, if an issuer or general partner plans to use funds for a real estate acquisition that does not ultimately transact, the third-party escrow agent will not transfer investor funds to the issuer or general partner, and funds will be returned to investors.

Unless otherwise disclosed, escrow accounts are not required for some investments that accommodate 1031 investments where the property is already acquired.

Our processes typically includes visiting certain properties (or a subset of properties if it's a fund) to confirm the real estate is what and where the real estate is supposed to be. For certain properties that accommodate 1031 exchange investments, the team will review third-party prepared due diligence reports in lieu of a site visit.

We have formalized processes and checklists for every private placement deal listed on the platform.

Trion Properties

Trion Properties focuses on potentially maximizing investor returns by increasing net operating income throughout the holding period through a hands-on management style of heavy renovation and aggressive lease-up. Trion Properties is a private equity investment company which acquires opportunistic real estate investments that need moderate to heavy rehab on a mid to long term investment horizon.

Founded in 2005, Trion has successfully closed over $160 million in transactions through either the purchase of the fee simple interest or taking ownership of the asset through acquiring the non-performing debt. Trion Properties is managed by principals whose combined experience spans over 20 years in West Coast real estate markets and is in excess of one billion dollars in transactions.

http://www.trion-properties.com/

| Sponsor Portfolio | ||||||||||

| Currently Owned Properties | ||||||||||

| Property Address | City | Property Type | Date Acquired |

# of Units |

Square Feet | Status | Purchase Price |

Total Cost Basis | BOV/ Appraisal | Valuation Date |

| 3536 Watt Ave | Sacramento, CA | MF | 4/1/2013 | 128 | - | 2016 Sale | $4,900,000 | $5,932,025 | $10,000,000 | 2/1/2016 |

| 24510 Town Center Dr | Valencia, CA | Retail | 10/22/2013 | - | 26,186 | 2016 Sale | $6,900,000 | $7,900,000 | $11,000,000 | 11/10/2015 |

| 5416 Jackson St | North Highlands, CA | MF | 1/28/2014 | 185 | - | 2016 Sale | $9,300,000 | $10,738,981 | $16,000,000 | 1/15/2016 |

| 412 S Lake St | Los Angeles, CA | MF | 8/1/2013 | 41 | - | Cash-out Refi | $1,600,000 | $4,181,454 | $8,500,000 | 2/1/2016 |

| 4620 S Slauson Ave | Los Angeles, CA | MF | 9/12/2014 | 28 | - | Cash-out Refi | $6,750,000 | $7,418,379 | $10,000,000 | 2/17/2016 |

| 1802-1820 Pacific Coast Hwy | Redondo Beach, CA | Retail | 11/24/2014 | - | 20,191 | Stabilized | $5,781,250 | $6,962,500 | $9,800,000 | 7/10/2015 |

| Penn St | Whittier, CA | N/A | 6/1/2012 | - | N/A | Entitlement | $1,100,000 | $1,100,000 | n/a | n/a |

| 28955 Pacific Coast Hwy | Malibu, CA | Retail/ Office | 2/28/2014 | - | 16,711 | Renovating | $5,750,000 | $7,500,000 | n/a | n/a |

| 1804 NE 104th St | Portland, OR | MF | 5/14/2015 | 74 | - | Renovating | $6,642,598 | $8,122,000 | n/a | n/a |

| 3635 College Ave | San Diego, CA | MF | 6/15/2015 | 98 | - | Renovating | $9,650,000 | $12,441,030 | n/a | n/a |

| 6180 Aldama | Los Angeles, CA | MF | 7/31/2015 | 15 | - | Renovating | $3,375,000 | $4,113,253 | n/a | n/a |

| 2222 SW Spring Garden | Portland, OR | MF | 8/14/2015 | 44 | - | Renovating | $4,450,000 | $5,713,266 | n/a | n/a |

| 324 S Catalina St | Los Angeles, CA | MF | 11/23/2015 | 47 | - | Renovating | $7,540,000 | $8,245,741 | n/a | n/a |

| 23924 2nd St | Hayward, CA | MF | 12/23/2015 | 30 | - | Renovating | $6,650,000 | $7,830,000 | n/a | n/a |

| 348 Estabrook | San Leandro, CA | MF | 1/4/2016 | 38 | - | Renovating | $7,200,000 | $8,574,811 | n/a | n/a |

| Total | 728 | 63,088 | $87,588,848 | $106,773,440 | ||||||

| Sold Properties | ||||||||||

| Property Address | City | Property Type | Date Acquired |

# of Units |

Square Feet | Purchase Price |

Total Cost Basis | Sale Value | Sale Date | |

| 909 Sunshine Ave | El Cajon, CA | MF | 4/10/2013 | 22 | - | $2,350,000 | $2,619,213 | $3,740,000 | 5/7/2015 | |

| 3298 Mooney Blvd | Visalia, CA | Retail | 12/31/2012 | - | 57,254 | $2,746,650 | $2,756,277 | $4,000,000 | 6/1/2013 | |

| 7629-7633 Normal Ave | La Mesa, CA | MF | 11/20/2012 | 21 | - | $1,900,000 | $2,263,689 | $3,580,000 | 6/9/2015 | |

| Arden Loan Portfolio | Sacramento, CA | MF | 7/26/2012 | 224 | - | $5,750,000 | $6,085,860 | $7,134,385 | 2/1/2013 | |

| 1535 N Cedar Ave | Fresno, CA | MF | 7/13/2012 | 124 | - | $3,248,750 | $4,435,709 | $5,500,000 | 3/4/2015 | |

| 4318 Avalon | Los Angeles, CA | MF | 1/3/2012 | 11 | - | $515,000 | $563,902 | $680,000 | 7/18/2012 | |

| 2280 South Drive | Auburn, CA | MF | 12/30/2011 | 16 | - | $1,350,000 | $1,727,568 | $2,400,000 | 7/12/2012 | |

| 210 43rd Place | Los Angeles, CA | MF | 9/26/2011 | 30 | - | $949,000 | $1,040,393 | $1,480,000 | 6/25/2012 | |

| 8833 Tobias Ave | Panorama City, CA | MF | 9/21/2011 | 20 | - | $1,169,000 | $1,278,675 | $1,430,000 | 12/30/2011 | |

| 225 N Avenue 53 | Los Angeles, CA | MF | 4/28/2011 | 20 | - | $1,249,463 | $1,526,243 | $2,075,000 | 5/12/2012 | |

| 4620 Coliseum | Los Angeles, CA | MF | 12/17/2010 | 35 | - | $1,800,000 | $1,985,773 | $2,550,000 | 12/29/2011 | |

| 1324 57th St | Los Angeles, CA | MF | 11/23/2010 | 14 | - | $875,000 | $977,018 | $1,155,000 | 10/28/2011 | |

| 6407 10th Ave | Los Angeles, CA | MF | 5/5/2010 | 28 | - | $1,500,000 | $1,763,512 | $2,125,000 | 7/29/2011 | |

| East West Bank Portfolio | Los Angeles County, CA | MF | 8/14/2009 | 21 | - | $725,000 | $740,024 | $960,000 | 9/1/2010 | |

| 13490-13520 Foothill Blvd | Sylmar, CA | MF | 6/4/2007 | 81 | - | $11,150,000 | $11,786,570 | $12,850,000 | 7/1/2008 | |

| 7445 Vineland | Sun Valley, CA | MF | 4/10/2007 | 20 | - | $1,867,125 | $1,928,485 | $2,250,000 | 8/5/2008 | |

| 4632 Laurel Canyon (1) | Valley Village, CA | MF | 3/20/2007 | 44 | - | $5,225,000 | $5,529,035 | $4,851,125 | 5/29/2009 | |

| 12717 Barbara Ann | North Hollywood, CA | MF | 11/2/2006 | 24 | - | $2,625,000 | $2,800,887 | $3,200,000 | 4/10/2009 | |

| 417 W Los Feliz | Glendale, CA | MF | 12/30/2005 | 34 | - | $2,200,000 | $2,444,000 | $3,495,000 | 5/17/2007 | |

| 7355 - 7359 Vineland | Sun Valley, CA | MF | 12/28/2005 | 12 | - | $1,147,466 | $1,263,093 | $1,600,000 | 4/11/2007 | |

| Realized Total | 801 | 57,254 | $50,342,454 | $55,515,926 | $67,055,510 | |||||

| Combined Portfolio Total | 1,529 | 120,342 | $137,931,302 | $162,289,366 | ||||||

At A Glance

| Investment Strategy: | Buy and Hold |

| Projected Hold Period: | 5 years |

| Total Project Budget: | $8,135,104 |

| Property Type: | Multifamily |

| Number of Units: | 74 units |

| Net Rentable Area: | 71,194 square feet |

| Cap Rate (Trailing 12-Month): | 6.1% |

| Cap Rate (Year 1): | 4.8% |

| Distributions to Realty Mogul 35, LLC: | 10% preferred return 70/30 split thereafter |

| Projected IRR: | 15.8% - 18.3% |

| Projected Cash on Cash (Avg): | 7.1% - 8.7% |

| Projected Equity Multiple: | 2.00x - 2.20x |

| Projected First Distribution: | August 2016 |

| Distribution Schedule: | Quarterly (starting 2016) |

| Investor Funding Deadline: | April 28, 2015 |

| Estimated Closing Date: | May 15, 2015 |

Investment Details

Trion HAI, LLC (the "Sponsor") plans to acquire, renovate and reposition the Woodland Park Estates (the "Property"), a 74-unit multifamily property located in Portland, Oregon. Realty Mogul investors are being provided the opportunity to invest in Realty Mogul 35, LLC. Realty Mogul 35, LLC, will be making an investment in Woodland Park Estates Apartments, LLC, the entity that will hold title to the Property.

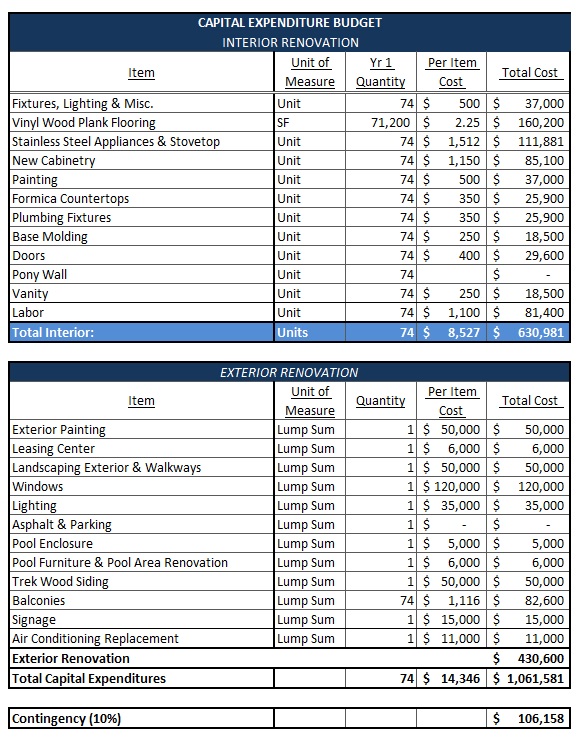

Through Woodland Park Estates Apartments, LLC, the Sponsor will handle all aspects of the investment including acquiring the property, completing a renovation program, and ultimately selling the asset. The Sponsor plans to renovate the 74 units as leases expire to bring the units in line with the rents being achieved elsewhere in the submarket. The Sponsor has budgeted $630,981 ($8,527 per unit) for interior renovations which include new lighting, vinyl wood plank flooring, stainless steel appliances, cabinets, countertops, plumbing fixtures, new paint and doors. In addition to the interior renovations, $430,600 will be spent on exterior improvements which should increase the overall appearance of the Property. For the exterior work, the Sponsor is planning to add new wood siding, a modern paint scheme, landscaping, lighting and contemporary railings and fixtures to the Property.

The Sponsor intends to hold the property for five (5) years before exiting the investment, though the hold period could be longer or shorter. Realty Mogul investors have the opportunity to participate as equity stakeholders and earn a share of the cash-flow and appreciation. Investors can expect to receive quarterly updates starting August 2015 and quarterly distributions starting August 2016.

This transaction represents a unique opportunity to invest in a well-occupied multifamily property located near numerous demand drivers in a strong market. The property has existing in-place cash flow while also offering investors value-add potential through a strategic renovation program.

Investment Highlights

- Located Near Demand Drivers and Transportation Routes: The Property is located within six miles of Downtown Portland, near numerous employment and retail centers. The Gateway submarket is considered to be one of the most accessible districts in all of Portland, with access to I-84, I-205, multiple bus lines and light rail stations.

- Rental Upside Demonstrated at Comparable Properties: Gateway Crossing Apartments, which is located 0.7 miles from the Property, recently underwent renovations similar to the planned business plan at the Property. Gateway Crossing has been successful in leasing up the renovated units at market rents and, the asset is of similar vintage, amenities and appearance. Two bedroom units at Gateway Crossing are currently renting for $1,150 per month, compared to a projected $1,095 per month at the Property (on a post renovation basis). Connery Place, located three (3) miles from the Property and also of similar vintage and amenities, underwent a similar renovation and was successful in raising rents 34% from $720 to $965 per month. The completion of a similar business plan at these two (2) properties proximate to the Property potentially supports the current business plan as well as the capacity for the market to support the Sponsor's projected post-renovation rents.

- Favorable Submarket Fundamentals: The Property is located in East Portland within the Gateway submarket, a neighborhood projected to experience rent growth of 5.7% in 2015 according to the Marcus & Millichap Portland annual report. The Property is located in a submarket with 1.6% vacancy and increasing rental rates. The Property has been well occupied historically (4.5% average vacancy since 2012). The majority of households are projected to be in the $50,000-74,999 median income bracket by 2018. According to Marcus & Millichap, rental growth over the past year has been positive, with vacancies projected to continue to drop and a forecast of increased investor interest, specifically in East Portland.

- Highly Occupied Property With a Diversified Tenant Base: Woodland Park consists of 74 units spread across nine buildings and is currently 97% occupied, providing investors with cash flow from a diversified working class tenant base in a stabilized and highly occupied submarket.

- Experienced Sponsor: The sponsor is an experienced multifamily operator who has completed over $113 million in transactions. They specialize in employing a hands-on management style of heavy renovation and aggressive lease up. Since its inception in 2005, Trion has generated an average internal rate of return in excess of 40%.

Risks and Risk Mitigation*

- Forward-Looking Statements: Investors should not rely on any forward-looking statements made regarding this opportunity, because such statements are inherently uncertain and involve risks. We use words such as “anticipated,” “projected”, “forecasted”, “estimated”, “prospective”, “believes,” “expects,” ”plans” “future” “intends,”, “should,” “can”, “could”, “might”, “potential,” “continue,” “may,” “will,” and similar expressions to identify these forward-looking statements.

- Illiquid Investment - Transfer Restrictions & No Public Market: The transferability of membership interests in Realty Mogul 35, LLC are restricted both by the operating agreement for that entity and by U.S. federal and state securities laws. In general, investors will not be able to sell or transfer their interests. There is also no public market for the investment interests and none is expected to be available in the future. Persons should not invest if they require any of their investment to be liquid. This is particularly important for persons of retirement age, who should plan carefully to assure that their assets last throughout retirement.

- Extensive Rehab Planned: The Sponsor intends to renovate all 74 (100%) units at the Property. The renovation timeline assumes that the renovation is completed over an 11-month period. This timeline equates to approximately seven (7) units being renovated per month. Additionally, the underwriting assumes that none of the units being renovated in any one month would generate any revenue that month. In order to justify an increase in rents of 41%, a significant amount of work must be done to the units. The Sponsor has budgeted $8,465/unit for renovations, but a significant amount of those costs are due to the high level of cosmetic finishes as opposed to structural work. The Sponsor's model assumes a 15% vacancy in year 1 in addition to the units being renovated.

- Decrease in Rents or Occupancy: One of the risks associated with this transaction is the possibility of a significant decline in rents or occupancy. This risk is mitigated by two factors: 1) historical occupancy at the Property since 2012 has averaged 95%, and the Property is currently 97% occupied, and 2) once completed, the renovations are expected to increase the attractiveness of the Property to potential renters.

- Management Risk: Investors will be relying solely on the manager of Woodland Park Estates Apartments, LLC for the execution of its business plan. That manager in turn may rely on other key personnel with relevant experience and knowledge, including contractors and consultants. Members of Woodland Park Estates Apartments, LLC (including Realty Mogul 35, LLC) will agree to indemnify the manager in certain circumstances, which may result in a financial burden if any litigation results from the execution of the business plan. While the manager of Woodland Park Estates Apartments, LLC has significant operating experience, Woodland Park Estates Apartments, LLC is a newly formed company and has no operating history or record of performance.

- Uncertain Distributions: The manager of Woodland Park Estates Apartments, LLC cannot offer any assurances that there will be sufficient cash available to make distributions to its members (including Realty Mogul 35, LLC) from either net cash from operations or proceeds from the sale of the asset. That manager, in its discretion, may retain any portion of such funds for property operations or capital improvements.

- Risk of Interest Charges or Dilution for Capital Calls: The amount of capital that may be required by Woodland Park Estates Apartments, LLC from the Company is unknown, and although Woodland Park Estates Apartments, LLC does not require that its members contribute additional capital to it, it may from time to time request additional funds in the form of additional capital. The Company does not intend to participate in a capital call if one is requested by Woodland Park Estates Apartments, LLC and in such event the manager of Woodland Park Estates Apartments, LLC may accept additional contributions from other members of Woodland Park Estates Apartments, LLC. Amounts that the manager and/or the contributing members of Woodland Park Estates Apartments, LLC advance on behalf of the Company will be deemed member loans or additional capital contributions. In the case it is deemed as additional capital, the Company's interest in Woodland Park Estates Apartments, LLC will suffer a proportionate amount of dilution.

- General Economic and Market Risks: While the Sponsor has conducted significant research to justify the intended rental rates and sales price relative to comparable properties in the market, its best efforts to forecast economic conditions cannot state for certain whether or not investor sentiment and the capital markets will be favorable to the property at the intended disposition date. The real estate market is affected by many factors, such as general economic conditions, the availability of financing, interest rates and other factors, including supply and demand for real estate investments, all of which are beyond the control of the manager of Woodland Park Estates Apartments, LLC.

*The above is not intended to be a full discussion of all the risks of this investment. Please see the Risk Factors in the Investor Document Package for a discussion of additional risks.

| Address: | 1820 NE 104th Ave Portland, OR 97220 |

| Submarket: | East Portland |

| Neighborhood: | Gateway |

| Year Built: | 1969 |

| Current Occupancy: | 97% |

| Number of Units: | 74 units |

| Net Rentable Area: | 71,194 square feet |

| Buildings: | 9 two-story buildings |

| Parking: | 85 total spaces |

| In Place Rent Per Unit: | $780 |

| Effective Rent Per Square Foot: | $0.81 |

| UNIT TYPE | TOTAL UNITS |

UNIT SF | TOTAL SF | IN PLACE RENTS |

PSF |

|---|---|---|---|---|---|

| 2 x 1 | 68 | 950 | 64,600 | $771 | $0.81 |

| 3 x 1.5 | 2 | 1,011 | 2,022 | $920 | $0.91 |

| 3 x 2 | 4 | 1,143 | 4,572 | $870 | $0.76 |

| TOTAL/AVG | 74 | 962 | 71,194 | $780 | $0.81 |

Property Highlights

- The Property is located in close proximity to numerous retail outlets, public spaces, public transportation routes and Interstates 84 and 205.

- The Property is located two blocks north of Northeast Halsey Street, a major commercial area, as well as five blocks from the Gateway Max Light Rail Station.

- The Property is nearby the Vibra Specialty Hospital of Portland, the Kaiser Permanente Gateway Medical Office, Mall 205, and the area's community colleges that serve over 89,000 students.

- Amenities consist of on-site laundry, a swimming pool, on-site parking and a business center.

- The Property's unit mix is comprised of two and three bedrooms units which is in line with market comparables. The average household size in the Property’s vicinity is 2.51 people.

The Property is located in the Gateway neighborhood within the East Portland submarket, which is in close proximity to retail amenities, employment centers, public transit and major transportation routes which provide ease of access to downtown Portland and the surrounding areas.

Portland Market Overview

Portland ranked as the nation’s 29th largest city in 2010 (per the US census) and the third most populous city in the Pacific Northwest Region. The population for Portland city was 583,786 in 2010, an increase of 10% since 2000. The population of the Portland-Vancouver-Hillsboro Metropolitan Statistical Area ("MSA"), which includes Clackamas, Columbia, Multnomah, Washington and Yamhill counties in Oregon, and Clark and Skamania counties in Washington, totaled approximately 2,226,009 residents in 2010, making Portland the 24th largest MSA in the country at that time. The economy of Portland is driven by a variety of business sectors, including government, education, manufacturing, life sciences, healthcare, retail trade, and financial services.

East Portland Multifamily Submarket Overview

The East Portland apartment submarket is comprised of the Gateway, Centennial, Glenfair, Hazelwood, Lents, Powellhurt-Gilbert, Mill Park, Parkrose Heights, Pleasant Valley, Russell and Wilkes neighborhoods. According to CoStar, the submarket consists of 469 properties, totaling 11,942 units as of 4Q2014. The East Portland submarket experienced zero completions during the quarter, driving demand rental rates to an all-time high. With such low number of new project deliveries - 190 units since the downturn - rents at existing properties have increased over 21% since 2010. According to CoStar, current average rents in the East Portland submarket are $833, with a current average occupancy of 96.5%.

Portland Multifamily Market Overview

The market information below is provided by the 3Q2014 Colliers International Portland Multifamily Research & Forecast Report:

The Portland MSA's GDP increased 22.8% from 2008 to 2013, the fastest growth of all major metropolitan areas in the U.S. As a result, the multifamily vacancy rate for all classes of product currently registers at 3.66%. Demand metrics continue to drive new development, as multifamily permits are 86% higher year-over-year. Despite the delivery of new units, underlying demand metrics and demographics are expected to be sufficient to translate into continued declines in vacancy rates in the majority of submarkets for the next 12 to 18 months.

In the investment arena, multifamily transaction volume rose 13% during the past 12 months, following a 15% jump one year earlier. Investor interest in the Portland MSA has kept cap rates for quality assets in good locations around the low- to mid-5% range.

Outlook from the Marcus & Millichap 2Q2014 Apartment Research Market Report:

- During 2014, the Portland MSA is expected to gain nearly 3,500 residents between the ages of 20 and 34, the primary renter cohort.

- Developers are on track to complete 4,000 rentals in the MSA in 2014.

- Average effective rents are expected to rise 5.7% to $1,033 per month in 2014.

- Rent growth should continue to attract investors to apartment assets in the Portland MSA. Value-add plays near employment hubs should garner significant buyer attention.

RM Securities, LLC, its registered representatives, affiliates, associated persons, and personnel of its affiliates who may also be associated with it, including our associated persons and personnel of our affiliates who are also be associated with RM Securities, LLC (it (“RM Securities,” “we,” “our,” or “us”) will receive fees, expense reimbursements, and other compensation (“Fees”) from the issuer of this investment offering, its sponsor, or an affiliate thereof (“Sponsor”), or otherwise in connection with Sponsor’s offering. The Fees paid to us are in addition to other fees you will pay to Sponsor or in connection with Sponsor’s investment offering. You will pay Fees to Sponsor, either directly or indirectly as an investor in the Sponsor’s offering. Sponsor will use the Fees you pay, as well as funds you invest in the relevant offering, to compensate us. The Fees paid to us will directly or indirectly be borne by you as the investor (typically, but not always, in the form of an expense of the Sponsor’s offering in which you invest) because such Fees will reduce the proceeds available for distribution to you and reduce the amount you earn over time.

For more information on the Fees paid to us, or any other Fees you will pay in connection with Sponsor’s offering, please carefully review the Sponsor’s Investment Documents. Please also carefully review RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

No Approval, Opinion or Representation, or Warranty by RM Securities, LLCSponsor has provided, approved, and is solely responsible in all aspects for the information on this webpage (“Page”), including Sponsor’s offering documentation, which may include without limitation the Private Placement Memorandum, Operating or Limited Partnership Agreement, Subscription Agreement, the Project Summary and all exhibits and other documents attached thereto or referenced therein (collectively, the “Investment Documents”). The Investment Documents linked on this page have been prepared and posted by Sponsor, and not by RM Securities. We did not assist in preparing, do not adopt or endorse, and we are not otherwise responsible for, the Sponsor’s Investment Documents. We make no representations or warranties as to the accuracy of information on this Page or in the Sponsor’s Investment Documents and we accept no liability therefor. No part of the information on this Page or in the Sponsor’s Investment Documents is intended to be binding on us.

Sponsor’s Information Qualified by Investment DocumentsThe information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Neither RM Securities nor Sponsor are obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments. For additional information on RM Securities’ involvement in this offering, please carefully review the Sponsor’s Investment Documents, and RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. RM Securities and its affiliates make no representation or warranty of any kind with respect to the tax consequences of your investment or that the IRS will not challenge any such treatment. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.